Recent Posts

The latest research content from TheSpreadSite.com and @TheSpreadThread1

Part 3: Electric Utilities Paid Members Public

Summary 1. Utilities are historically viewed as a defensive play given stable dividend yields and EPS growth rates. Analyzing yield and valuation is more straightforward relative to BDCs and midstream equities with the two most common approaches being relative P/E ratios (vs S&P 500) and dividend yield

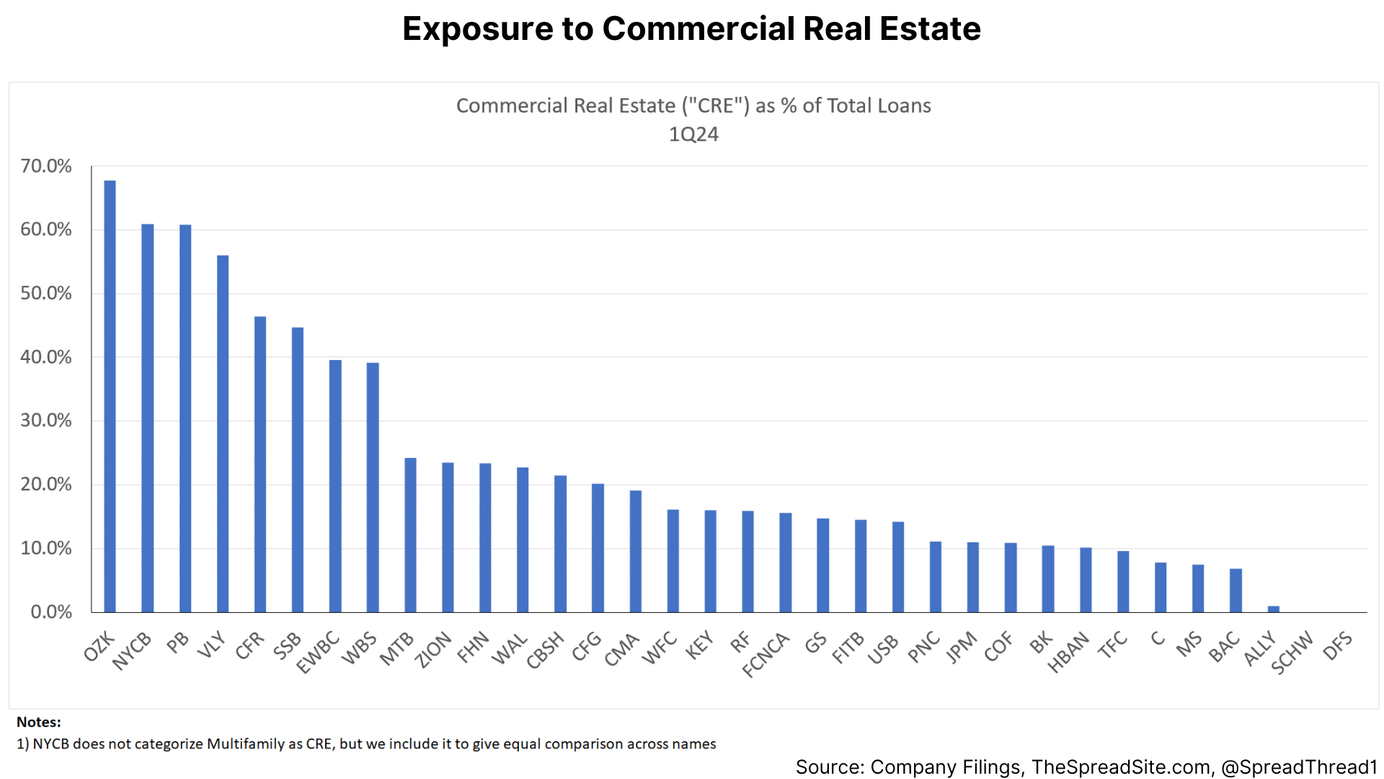

Bank Stocks, Charts & Data: 1Q24 Paid Members Public

The Banking Sector In Charts We are through 1Q24 bank earnings and compile our quarterly charts below. Data is sourced from 10Qs, supplemental data issued with earnings releases or via Call Reports available on the FDIC's website. Our method, generally speaking, is to include all banks in the

Part 2: BDCs Paid Members Public

Summary 1. Business Development Companies (“BDCs”) offer high dividend yields as they make floating rate, high yielding loans to small and mid-sized businesses. However, dividend yield is a flawed valuation measure when looking at the sector. Net Investment Income Yield as well as factors that impact book value are more

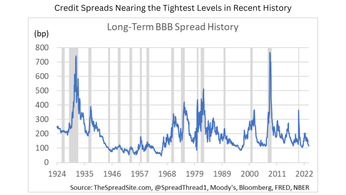

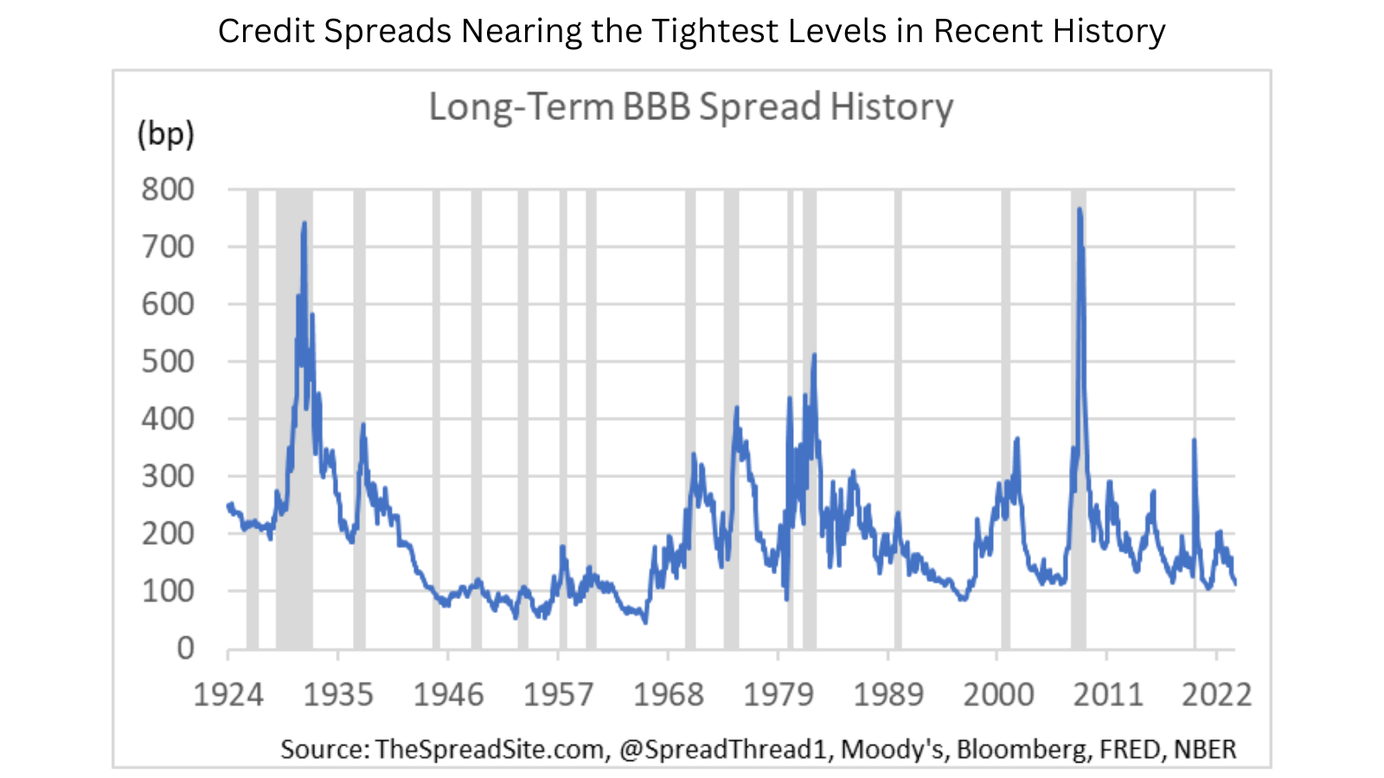

Credit Check Paid Members Public

Credit markets have rallied aggressively so far this year, along with most risk assets, continuing the bull market that begin in late 2022. In this week’s note we provide a brief update on corporate credit and a few thoughts looking forward. First, both investment grade and high yield credit

Part 1: Midstream Energy Paid Members Public

Summary 1. Comparing equity yields in midstream energy with fixed income can be challenging given its added risk and growth components. Metrics such as dividend yield and free cash flow yield do not provide a full picture and we walk through two approaches for analyzing yield. 2. The midstream sector

Ahead of the Fed Paid Members Public

Markets are two days away from a Fed meeting, which has the potential to rattle this ‘Goldilocks’ market. Taking a step back, over the last 4-5 months, stocks have moved higher in nearly a straight shot, and bonds have been mostly range-bound. A still healthy economy, optimism around a 1990s-like

SPWH: A Post-COVID Deer in Headlights Paid Members Public

Going forward, we plan on occasional posts like this where we don't do a deep-dive, but provide high level thoughts on idiosyncratic situations we are watching. Summary 1. SPWH is facing a post-COVID hangover with weak sales trends and declining margins after opening too many stores. 2. We

A Two-Tiered Economy Part Two Paid Members Public

Summary * This week, we once again explore the bifurcation in the economy, which we believe is large and set to grow. In short, parts of the economy are clearly doing well, even thriving, despite higher rates. Other areas have been struggling, such as companies with high leverage/ little FCF, consumers