Market Insights

Top-down insights on the economy and macro markets

Credit Check Paid Members Public

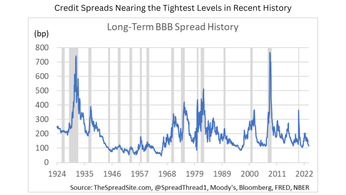

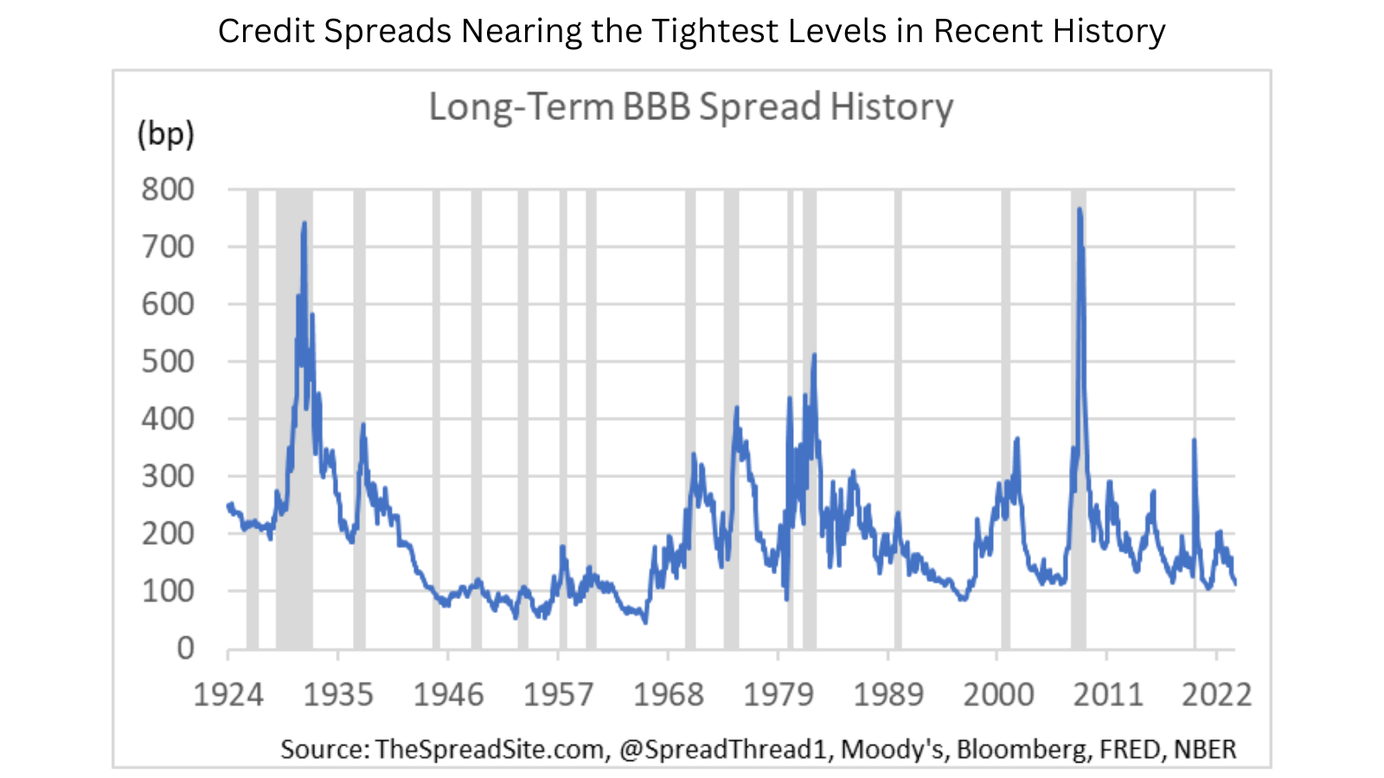

Credit markets have rallied aggressively so far this year, along with most risk assets, continuing the bull market that begin in late 2022. In this week’s note we provide a brief update on corporate credit and a few thoughts looking forward. First, both investment grade and high yield credit

Ahead of the Fed Paid Members Public

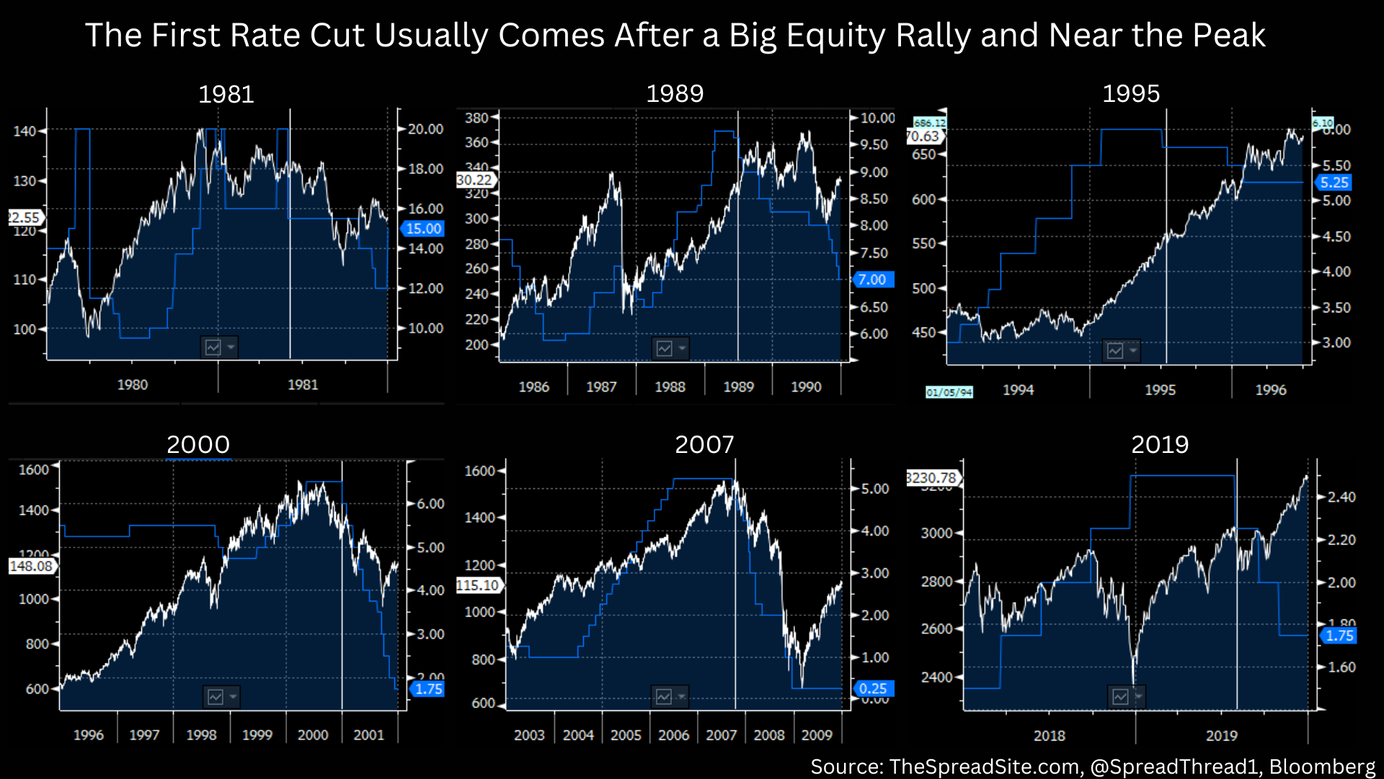

Markets are two days away from a Fed meeting, which has the potential to rattle this ‘Goldilocks’ market. Taking a step back, over the last 4-5 months, stocks have moved higher in nearly a straight shot, and bonds have been mostly range-bound. A still healthy economy, optimism around a 1990s-like

A Two-Tiered Economy Part Two Paid Members Public

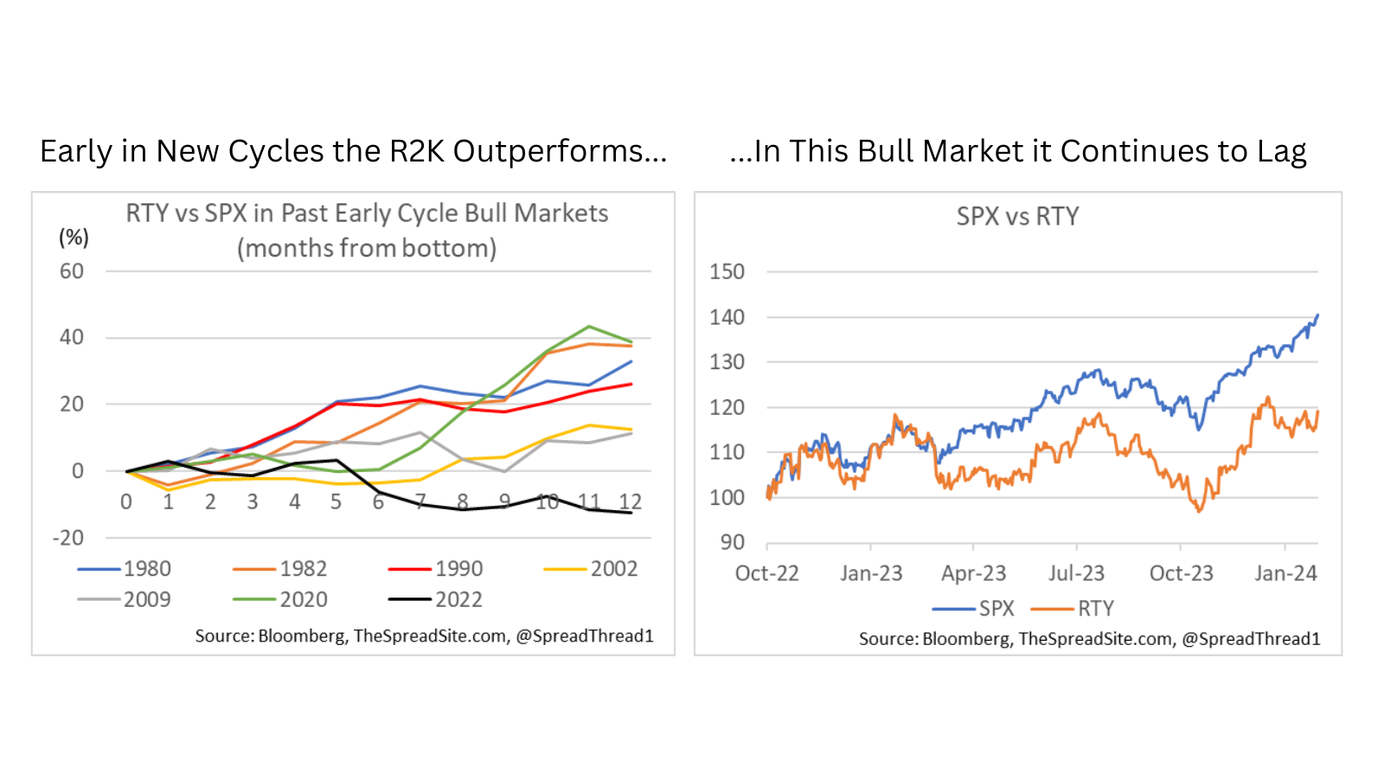

Summary * This week, we once again explore the bifurcation in the economy, which we believe is large and set to grow. In short, parts of the economy are clearly doing well, even thriving, despite higher rates. Other areas have been struggling, such as companies with high leverage/ little FCF, consumers

A Few Thoughts After a Hot CPI Print Paid Members Public

After rallying 22% in nearly a straight line, equity markets finally got a reason to selloff - today’s hot CPI release. A few quick takeaways: First, without getting into all the details, our view is that any one report can be noisy, especially in January, which tends to have

Have a Playbook Paid Members Public

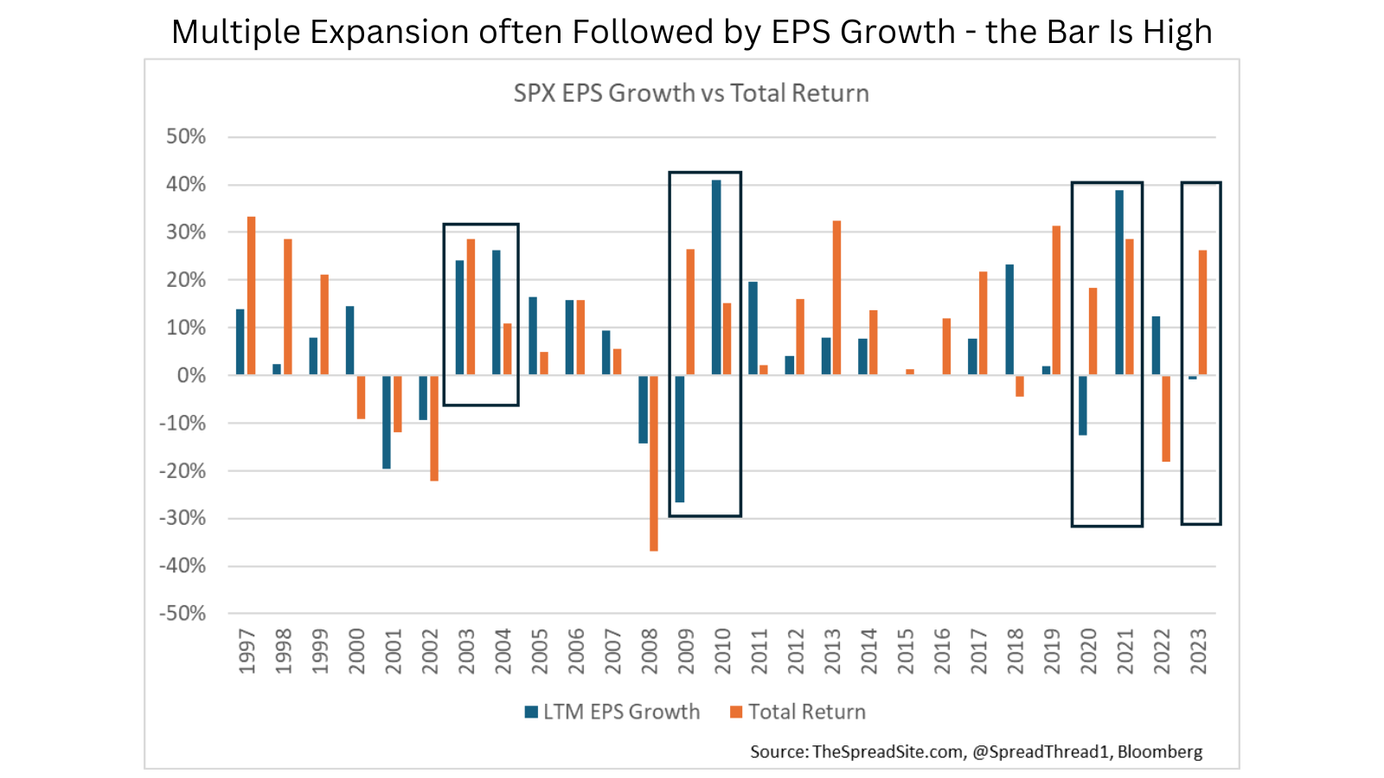

Summary * The market melt up continues, but the drivers have shifted. In Nov/Dec, markets were optimistic around declining inflation, more modest growth, less Treasury supply and this soft-landing optimism fueled a rally in both bonds and stocks. Small caps and banks led and Tech lagged. * Since the start of

Maybe Not So Different Paid Members Public

* Despite a Goldilocks backdrop now, the key challenge with a soft landing is that it’s tough to keep unemployment at trough levels for long – 3 yrs is the historical max, and we are ~2yrs sub 4% now. In prior soft landings there turned out to be more labor mkt

Zombies Among Us Paid Members Public

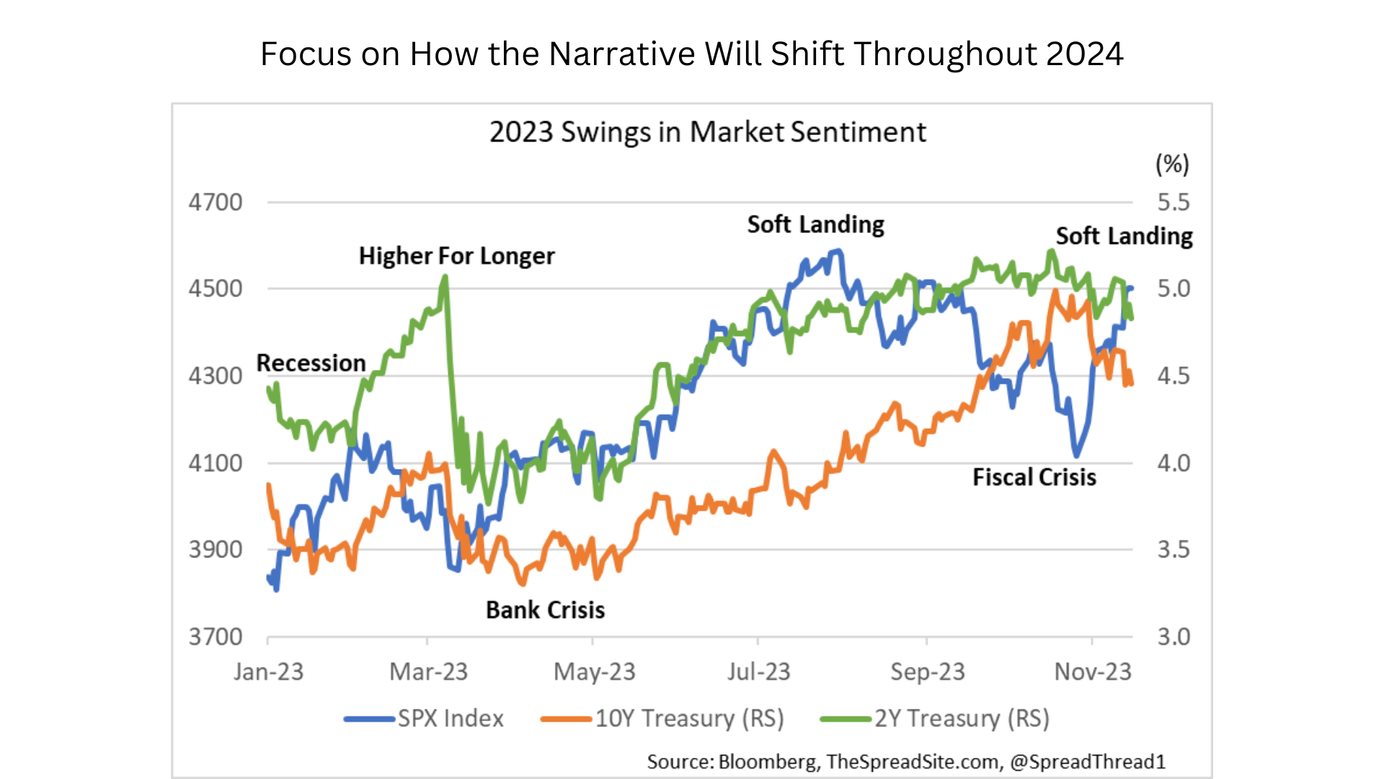

Summary * We continue to see large swings in sentiment in 2023, and it has paid not to get caught up in a narrative for long. Recession-> H4L-> bank crisis-> soft landing-> fiscal crisis. Now back to soft landing. We continue to believe many dynamics today are

Financial Conditions Tightening Paid Members Public

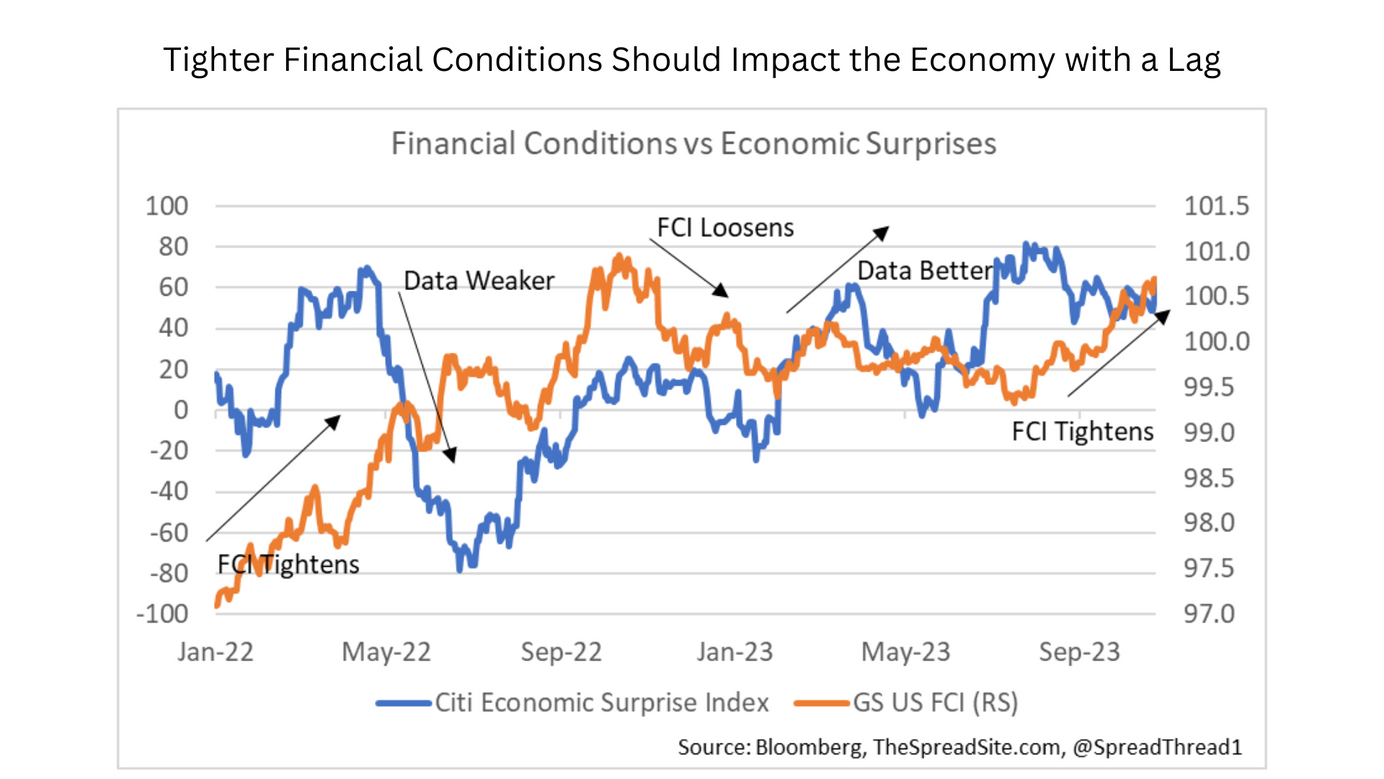

Summary * The key question today: Was growth in 3Q23 a temporary bounce in a bumpy late-cycle economy, or a more durable re-acceleration? We remain in the former camp and think markets are also looking beyond 3Q with economically-sensitive sectors hit hard since late July. Ultimately it comes down to how