Maybe Not So Different

- Despite a Goldilocks backdrop now, the key challenge with a soft landing is that it’s tough to keep unemployment at trough levels for long – 3 yrs is the historical max, and we are ~2yrs sub 4% now. In prior soft landings there turned out to be more labor mkt slack then initially perceived, but in those cases unemployment was 6-7%.

- Many who still agree on a hard landing disagree on the path. Some think the economy will re-accelerate first. We lean towards the view that cyclical momentum in growth/ inflation/ jobs is weakening which will take more than easier financial conditions to derail. In our view, bonds and increasingly cyclicals/small caps may be sniffing out this weakness.

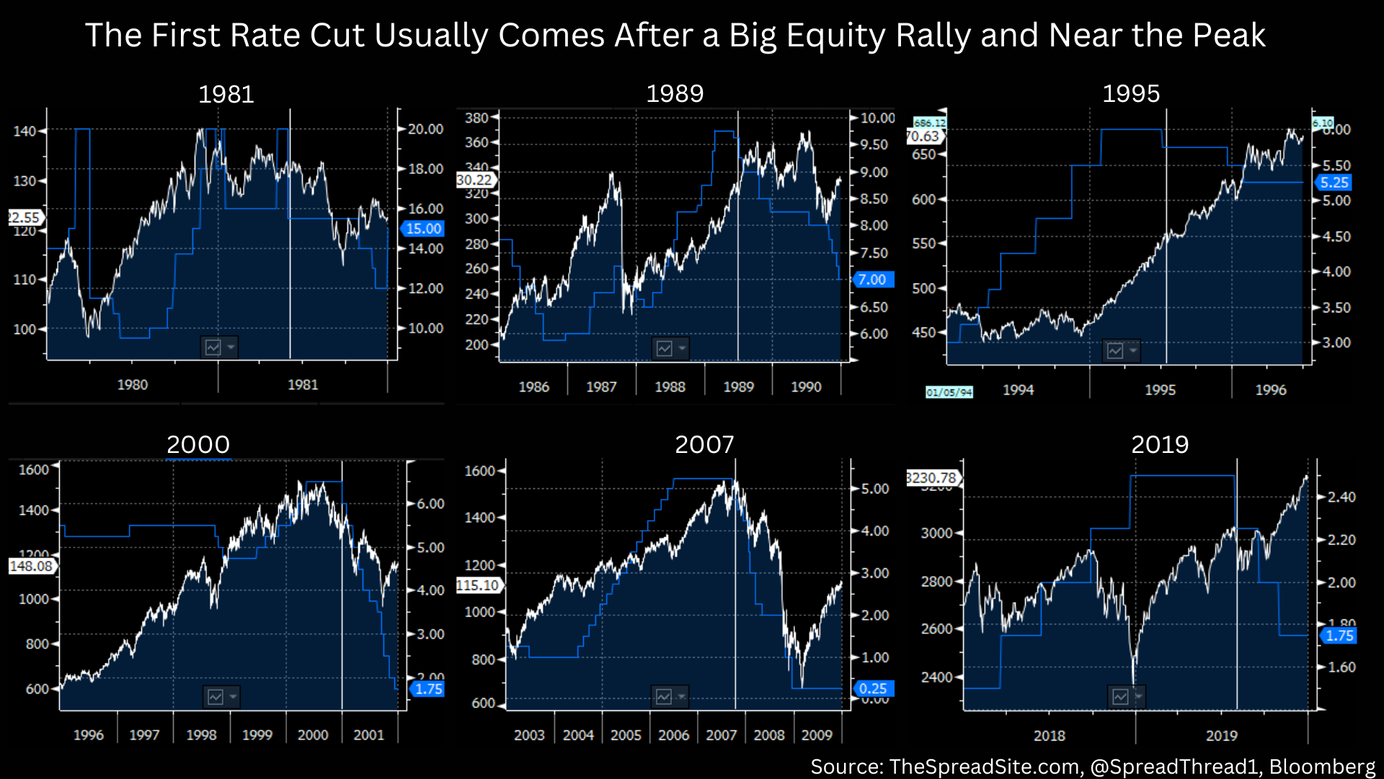

- Bigger picture, despite all the talk about how this cycle is so different, in many regards, timing and price action are playing out pretty normally - the Fed starting to cut while unemployment is still low, the timing between the last rate hike and a potential first cut, as well as the sharp equity rally leading into the first cut.

- Our bottom line remains the same. Despite all its differences, this cycle is quite typical in many regards. Going from late to end-of-cycle is often slow with many large swings along the way, a point we have made over and over. Continue to fade extremes, and look for parts of markets that are now least priced for deteriorating macro data.

Goldilocks Still Lives

Markets continue to bounce around near all-time highs, with the ‘Goldilocks’ narrative mostly intact, even if dented by a hot(ish) CPI report on Thursday. Stepping back from the day-to-day noise, inflation is near the Fed’s target on the measure they care most about, at least for now, and growth is tracking modestly above trend. What’s not to like?

The challenge – this narrative is now consensus, meaning it’s probably in the price. That doesn’t mean markets have zero upside if ‘Goldilocks’ continues to play out. But it does speak to overall risk/reward.

Challenges Remaining at Full Employment

So where do we go from here? As is usually the case, the answer is not clear cut. Many see a reacceleration in growth/inflation as the key risk. Others believe the hit from 525bp of rate hikes is far from done, and the bulls argue that the Fed can continue to thread the needle. Below is our take:

First, the too hot/ too cold debate speaks to the challenges in a late-cycle environment, when the jobs market is tight, and policy is restrictive. On the one hand, a rate hike cycle weakens the cyclical momentum in the economy, and because the economy is at full employment, companies have the ability (and willingness) to shed labor in response to the weakness. Rate cuts can help, but only with a lag. On the other hand, if growth does accelerate due to outside forces (fiscal stimulus, easier financial conditions, etc…) minimal slack means inflation pressures/ overheating are quick to re-appear.

Because of these late-cycle dynamics, unemployment never stays ultra-low indefinitely. As the chart below shows, unemployment has only remained at trough levels for 1-3yrs historically before a new up-cycle, and it has now been ~2 years since it dropped below 4%.

Of course, we never know the economy is at trough unemployment until after the fact. In the two modern-day soft landings, 1984 and 1994, it turned out there was much more slack in the labor market than initially perceived. Unemployment was able to continue declining for many years after the Fed stopped hiking. However, in those episodes, unemployment was ~7% and 6%, respectively, not 3.7% like today. In all likelihood, unless we see a big improvement in productivity or find a large untapped source of labor supply, the next move in unemployment is higher.

Momentum Likely Slowing

Many investors in the hard landing camp agree on the end-game laid out above. However, there is disagreement on the path to get there. Some think rate hike lags are still hitting, and growth is weakening as we speak. Others believe the economy/inflation are set to re-accelerate, which will lead to another bout of tightening from the Fed (or the pricing out of cuts) and thus eventually weaker growth, just further down the line. One of the key arguments for this re-acceleration is the sharp easing in financial conditions over the past 2.5 months.

Our big picture view is that this rate hike cycle will end in a hard landing, which hasn’t changed. We have less conviction on the exact path to get there, but lean towards the view that the cyclical impulse has turned and easier financial conditions won’t derail that momentum.

As we argued this week on Twitter/X, easier financial conditions are clearly a positive for growth. But digging into the transmission mechanisms, we think the magnitude of the boost to come will be less than many expect. Of course, there is a wealth effect and some boost to housing demand from modestly lower interest rates. However, unlike early in a new cycle, there are only so many workers to bring off the sidelines as confidence improves.

Additionally, through most cycles in recent history, thanks to a 40-year bond bull market, lower rates from easier financial conditions meant borrowers could immediately cut their debt costs. If you had a 6% mortgage and rates fell, you could quickly refi into a 5% mortgage. However, today, that is not the case, with most borrowers still benefitting from ZIRP-era debt costs. For example, if mortgage rates fall from 8% to 7%, you see no immediate benefit if your current rate is 3%. If yields in high yield drop from 9% to 8%, but your existing coupon is 5.75%, you also don’t benefit, as we show below. This dynamic doesn’t eliminate the tailwind from easier financial conditions, but it mutes the effect.

Additionally, as noted above, we think the cyclical momentum in the economy and in the jobs markets has weakened due to 525bp of rate hikes. For example, while just one datapoint, as we show below, activity is now slowing in 30 states, per the Philly Fed’s coincident indicators. Similarly, while overall job growth is fine and claims are low, the breadth of job growth across sectors is narrowing with cyclical sectors declining, private quits and hiring rates are now weaker than in 2019, revisions to payrolls have been consistently negative for about a year, the participation rate may be rolling over, and the ISM service index is potentially signaling a notable turn in service sector jobs.

Late cycle environments are famous for repeated head-fakes in both directions. But it’s important to take a step back at times and differentiate signal from noise. The US economy is a supertanker that is hard to turn once it picks a direction, and we believe for now it is pointing towards lower inflation and lower growth. Just like investors overestimated how quickly inflation would fall in 2022 (i.e., transitory) we think they may be now overestimating how quickly it will rebound.

Many in the sticky inflation crowd are quick to look at bonds pricing ~6 cuts in 2024 and claim the market is wrong. And to the point of head-fakes, rate cuts did get priced in and out several times last year. However, today, there is no banking crisis or recession consensus driving that pricing. It’s worth asking whether the bond market is not missing something, and instead sniffing out this weakening cyclical impulse. To the extent there was disagreement in bonds and stocks late last year, it was arguably the outperformance of cyclicals and small caps, even as bonds were rallying hard. Those economically-sensitive sectors may be rolling over again, suggesting the message in the bond market may be winning the fight.

Many Similarities

Finally, we know it is tempting to interpret markets near highs or the Fed likely to begin cutting despite low unemployment as mission accomplished for a soft landing. And we often hear that because this cycle was so different, historical relationships/indicators simply didn’t work.

Our high-level view is that yes, this cycle was different. They all are. But people forget how slow the process can be and how long late-cycle environments can feel, especially for those of us looking at markets minute-to-minute. In reality, a lot of what we see today is quite typical.

For example, the Fed beginning to cut rates while unemployment is still at or near a cycle trough is completely normal.

Additionally, the Fed beginning to cut 8 months after the last hike (assuming they go in March) would also be in the historical range, if anything longer than average.

Last and most importantly, the fact that the market rallies hard leading up to the first rate cut is not the sign of a soft landing, and does not prevent further rate cuts due to easier financial conditions. Again, in many cases historically, the market was at or near a high at the time of the first rate cut. Stocks rally because if rate cuts take place before the data has deteriorated, investors assume the Fed got it right. In cases where that sentiment is wrong because the data eventually turns (the majority of examples) stocks then decline, despite continued rate cuts.

Our bottom line remains the same. Despite all its differences, this cycle is quite typical in many regards. Going from late to end-of-cycle is often slow with many large swings along the way, a point we have made over and over. The fact that the process is so slow means you don’t want to simply sit in cash waiting for a downturn, as 2023 showed. This ‘Goldilocks’ phase, in particular, can last for a while. However, we encourage investors to continue fading extremes in sentiment and to look for parts of markets that are now least priced for a deterioration in the macro data. As usual, we will discuss more specific ideas along these lines in notes to come.

Disclosures

Please click here to see our standard legal disclosures.

The Spread Site Research

Receive our latest publications directly to your inbox. Its Free!.