Bank Stocks, Charts & Data: 1Q24

The Banking Sector In Charts

We are through 1Q24 bank earnings and compile our quarterly charts below. Data is sourced from 10Qs, supplemental data issued with earnings releases or via Call Reports available on the FDIC's website.

Our method, generally speaking, is to include all banks in the "KRE" Regional Bank ETF greater than ~$5b of market cap and all banks in the "KBE" Bank ETF greater than ~$10b of market cap.

30 to 89 Day Delinquencies

These charts are new as of 4Q23 and we think it will be important to watch trends on new delinquencies. This category indicates loans where the borrower is 30 to 89 days behind on payment but typically the loans are still accruing interest.

Most of this data is from Call Reports, and generally, these loans are not yet classified as non-performing. However, they could signal future provisions and charge-offs depending on the outcome (i.e. does the lender start paying or does the lender default and if so, what is the recovery on the loan).

Held-To-Maturity ("HTM") Securities

At the end of 4Q23, 10Y Treasury yields were 3.88% and 30Y yields were 4.03%. At the end of 1Q24, 10Y Treasury yields were 4.20% and 30Y yields were 4.34%. The increase of 32bp and 31bp, respectively, negatively impacted HTM portfolios.

Deposit Data

We show deposit rates as of 1Q24 and the Q/Q change. We use end-of-period deposit rates where available and the average rate if the former isn't provided. We also note this data includes zero cost deposits.

Net Interest Margin ("NIM")

NIMs remain generally lower or flat aside from a few outliers.

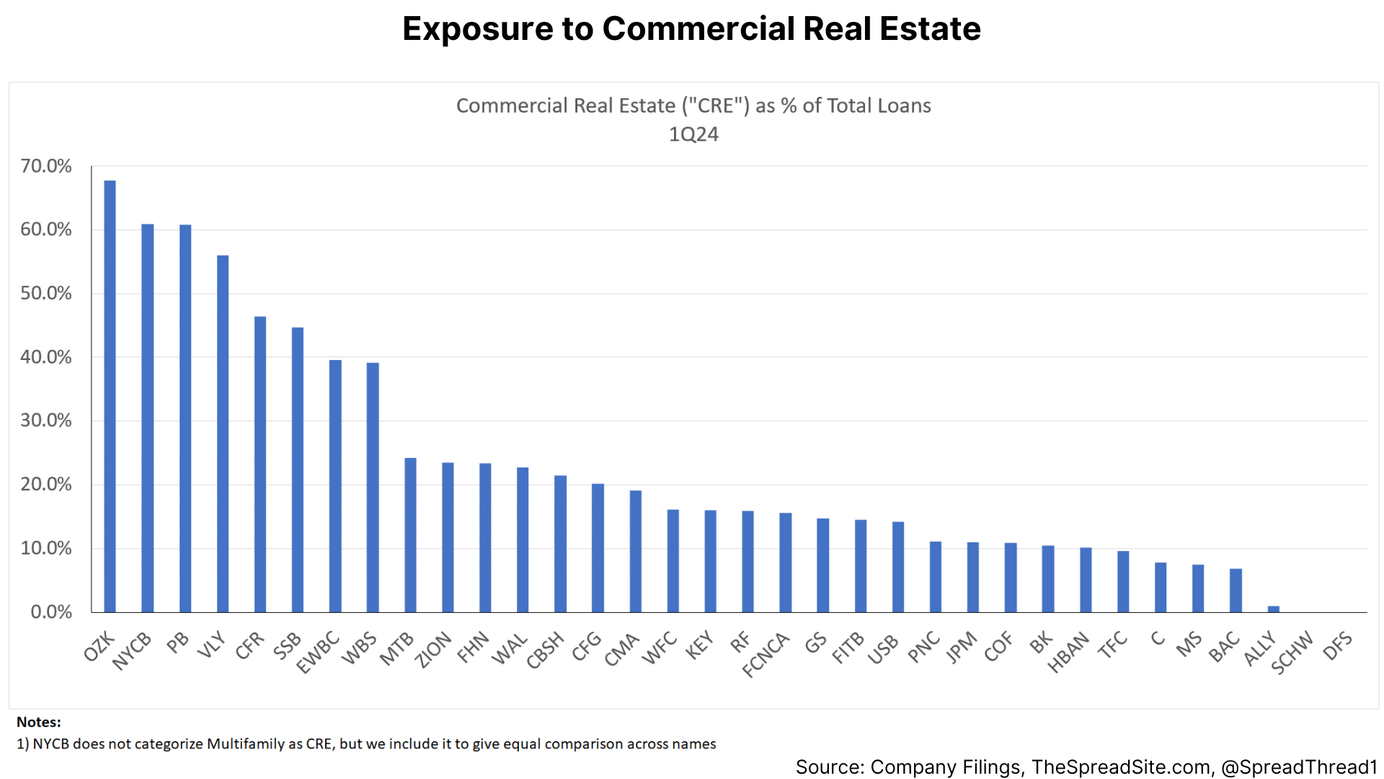

Loan Exposure by Category

In terms of commercial real estate ("CRE"), we show exposure to this category as a percent of total loans. We then show "Office" and "Multifamily" as CRE subsectors.

Loss Provisions & Allowances

Credit provisions were lower Q/Q, and aside from a large increase from Citigroup in 4Q23 (~$2b), provisions have been reasonably stable.

Loan loss allowances were higher for DFS and COF, both of which are credit card providers, and for NYCB, which is undergoing a restructuring after acquiring assets from Signature Bank.

Loan Growth

Lastly, we look at end-of-period ("EOP") loans outstanding (ave balances used if EOP data unavailable), which decreased on a Q/Q basis.

Disclosures

Please click here to see our standard legal disclosures.

The Spread Site Research

Receive our latest publications directly to your inbox. Its Free!.