A Two-Tiered Economy Part Two

Summary

- This week, we once again explore the bifurcation in the economy, which we believe is large and set to grow. In short, parts of the economy are clearly doing well, even thriving, despite higher rates. Other areas have been struggling, such as companies with high leverage/ little FCF, consumers who need to borrow to finance purchases, floating-rate borrowers, and much of the commercial real estate sector.

- Investors see the ‘Have Nots’ as small enough not to matter, a normal dynamic late in a cycle (i.e., “contained.”). And to be fair, this has been the right take so far. In our view, the problem sectors are not as small as some suggest. But a more important question: Why are delinquencies rising while growth is this strong, and unemployment this low.

- For now, the winners are winning big, driving a melt-up in markets – which is easing financial conditions and boosting sentiment. And if the strength in markets continues, it increases the odds that rate cuts, which are needed by these more vulnerable sectors, get pushed further and further out, exacerbating this two-tiered economy.

- The investment implications: The time to own ‘junk’ is in a true early-cycle recovery after growth has weakened and the Fed has cut rates. Until then, we think large-cap quality remains the winner, and we fade the periodic bouts of low-quality outperformance.

Price Drives Narrative

Markets tend to move first, and investors then scramble to explain the move after. This time is no different. Stocks are melting up, credit spreads are near historic tights, and we are hearing all sorts of reasons why. Mission accomplished on a soft landing, a 1990s-like productivity boom driven by AI, and of course, all of the reasons why rising rates don’t matter. To state the obvious, if stock prices were lower, the narratives would be less bullish, even if the macro backdrop were exactly the same.

Our view, especially when it comes to the debate on interest rates: We continue to have a bifurcated economy – more so today than usual. (See The Haves and Have Nots for our initial views on this theme). Parts of the economy are not sensitive to rising rates, while other areas are very exposed, to some extent why we have seen such a narrow, large-cap led rally.

For now, investors see the ‘Have Nots’ as small enough not to matter, a normal dynamic late in a cycle (i.e., “subprime is contained.”) The key risk is that as financial conditions ease due to bubble-like price action for a small subset of the market (the ‘Haves’ winning big), the Fed will pull back on cuts that are desperately needed by the more vulnerable sectors. This ‘two-tiered’ economy will grow even more bifurcated as a result. And it won’t matter until the problem sectors no longer seem contained.

Uneven Impact from Rising Rates

Clearly part of the economy has not experienced a negative impact from rising rates. The most obvious examples are large, cash-rich companies with low leverage and wealthy consumers – both benefitting from additional interest income, without a noticeable headwind from rising interest expense. We think these kinds of winners are few and far between. The more ‘normal’ winner, in our view, is a corporate or consumer that may not have substantial cash but has relatively low leverage and locked-in ZIRP-era debt costs. For example – the many consumers with ~3% mortgages. This cohort would likely struggle if its debt were re-struck at market rates, but can manage for now because these low debt costs will take time to roll off.

The outperformance of large, high-quality companies has been massive, illustrating the bifurcation in the market, and the importance of having a balance sheet immune from higher borrowing costs.

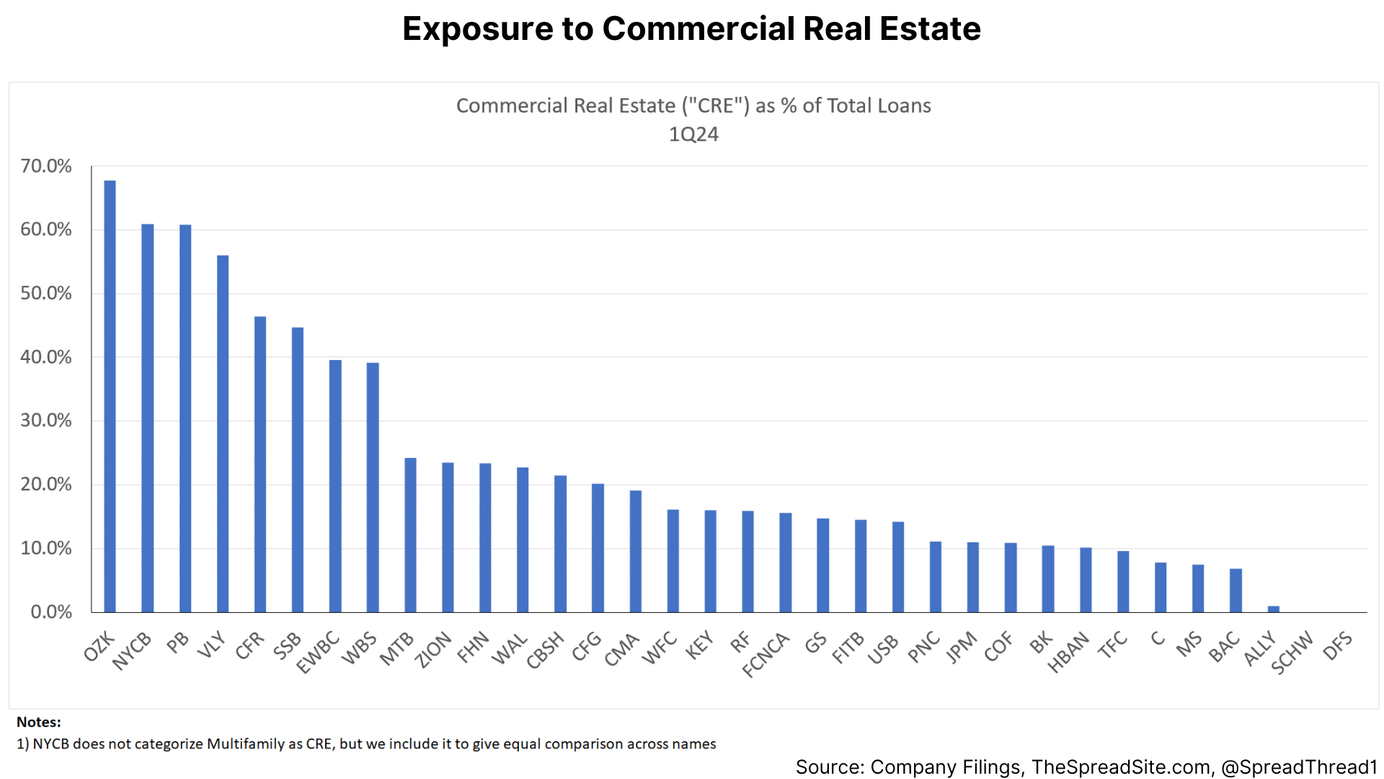

On the other end of spectrum, there are plenty of parts of this economy that are not sustainable with rates at current levels. For example, the many small and mid-sized businesses as well as commercial real estate borrowers with high leverage/ little FCF to support higher rates. Many lower income consumers that need to borrow to finance purchases. Floating-rate borrowers. And of course, lenders exposed to these more vulnerable sectors.

And these segments are not insignificant in size, despite arguments to the contrary, at least when added together. For example, many argue that short-rates don’t matter anymore. In fact, about 43% of non-financial debt is in loan form, UP from 35% in 2018. And importantly, the growth in leveraged debt this cycle, the riskiest borrowers, has come from leveraged loans and private credit, floating-rate markets, not from the mostly fixed-rate HY bond market. Additionally, around 1/3rd of commercial real estate debt is floating rate. These are just two examples.

As evidence that these more vulnerable parts of the economy are struggling with rates at current levels, the exhibit below shows rising delinquencies and defaults across pockets of the corporate debt market, consumer lending and commercial real estate. And yes, the aggregate volumes of defaulting/delinquent debt are low – which is true in any late cycle environment while the economy is still growing. But the point is that credit problems are getting worse not better, despite price action in markets. The question investors should ask: Will these issues get better or worse going forward, especially if unemployment begins to rise from its historic low level.

The Fed’s Dilemma

For now, however, none of these problems matter. Markets are ripping and as discussed earlier, narrative follows price. The narrative today is that the bulk of the economy is thriving (despite the narrow equity rally), and weak spots like CRE are known and small. So far, this thinking has been correct. The issue is that the melt-up in markets is having an impact. First, it is easing financial conditions and boosting sentiment. Second, easier financial conditions and the potential for stronger growth is seeping into Fed thinking. If markets remain exuberant, risks rise that the Fed remains on hold indefinitely.

In our view, this dynamic exacerbates the two-tiered economy by pushing out the cuts that are needed by these more vulnerable sectors. Policy may not be overly restrictive for the full economy (up for debate), but it is most definitely restrictive for the ‘Have Nots.’ Again, as long as the macro data holds up and cracks are perceived as small, it’s not an issue. But in the background the vulnerabilities will continue to build, especially if rate cuts continue to get priced out, until they will no longer seem ‘contained.’ At that point, the cuts will come fast.

We think the investment implications are straightforward. While companies with weaker balance sheets will see short periods of outperformance, they continue to face large headwinds. Eventually growth will weaken, driving a proper rate cutting cycle and setting markets up for a true early-cycle recovery. That will be the point in the cycle to own ‘junk.’ Until then, we think large-cap quality remains the medium-term winner.

Disclosures

Please click here to see our standard legal disclosures.

The Spread Site Research

Receive our latest publications directly to your inbox. Its Free!.