Company Analysis

Fundamental analysis on sectors, stocks and corporate bonds

Part 3: Electric Utilities Paid Members Public

Summary 1. Utilities are historically viewed as a defensive play given stable dividend yields and EPS growth rates. Analyzing yield and valuation is more straightforward relative to BDCs and midstream equities with the two most common approaches being relative P/E ratios (vs S&P 500) and dividend yield

Part 2: BDCs Paid Members Public

Summary 1. Business Development Companies (“BDCs”) offer high dividend yields as they make floating rate, high yielding loans to small and mid-sized businesses. However, dividend yield is a flawed valuation measure when looking at the sector. Net Investment Income Yield as well as factors that impact book value are more

Part 1: Midstream Energy Paid Members Public

Summary 1. Comparing equity yields in midstream energy with fixed income can be challenging given its added risk and growth components. Metrics such as dividend yield and free cash flow yield do not provide a full picture and we walk through two approaches for analyzing yield. 2. The midstream sector

SPWH: A Post-COVID Deer in Headlights Paid Members Public

Going forward, we plan on occasional posts like this where we don't do a deep-dive, but provide high level thoughts on idiosyncratic situations we are watching. Summary 1. SPWH is facing a post-COVID hangover with weak sales trends and declining margins after opening too many stores. 2. We

An Update After 4Q23 Gold Miner Earnings Paid Members Public

Gold Moving Sideways So far to start the year, gold has bounced around in a fairly tight range ($2000 - $2050). We are actually somewhat encouraged by the price action. First, over the same time period, 10Y real yields have risen by around 30bp. This selloff in bonds should have

Spirit (Airlines) in the Sky Paid Members Public

Summary * We believe the Spirit/JetBlue merger is dead and leaves Spirit facing tough industry fundamentals along with a large $1.1b debt maturity in 2025. Capacity in the domestic air travel market is outpacing demand and rising operating costs are outpacing price increases. * Spirit (and airlines generally) are incredibly

The Case for Gold Miners in 2024 Paid Members Public

Summary * We think gold can outperform this year in various scenarios – for example, if the Fed pushes too aggressively for a soft landing through rapid cuts, or alternatively if employment rolls over quicker than many expect. We like playing the asset class through gold miners, and this report analyzes the

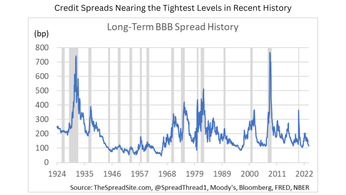

Front End Corporates Paid Members Public

Introduction Markets surged in the last two months of 2023, leaving investors with few attractive options to start 2024. Stocks are off to a bumpy start after the first few days of the year, but still just off all-time highs. Bonds, where we had been bullish, are also less compelling