An Update After 4Q23 Gold Miner Earnings Paid Members Public

Gold Moving Sideways So far to start the year, gold has bounced around in a fairly tight range ($2000 - $2050). We are actually somewhat encouraged by the price action. First, over the same time period, 10Y real yields have risen by around 30bp. This selloff in bonds should have

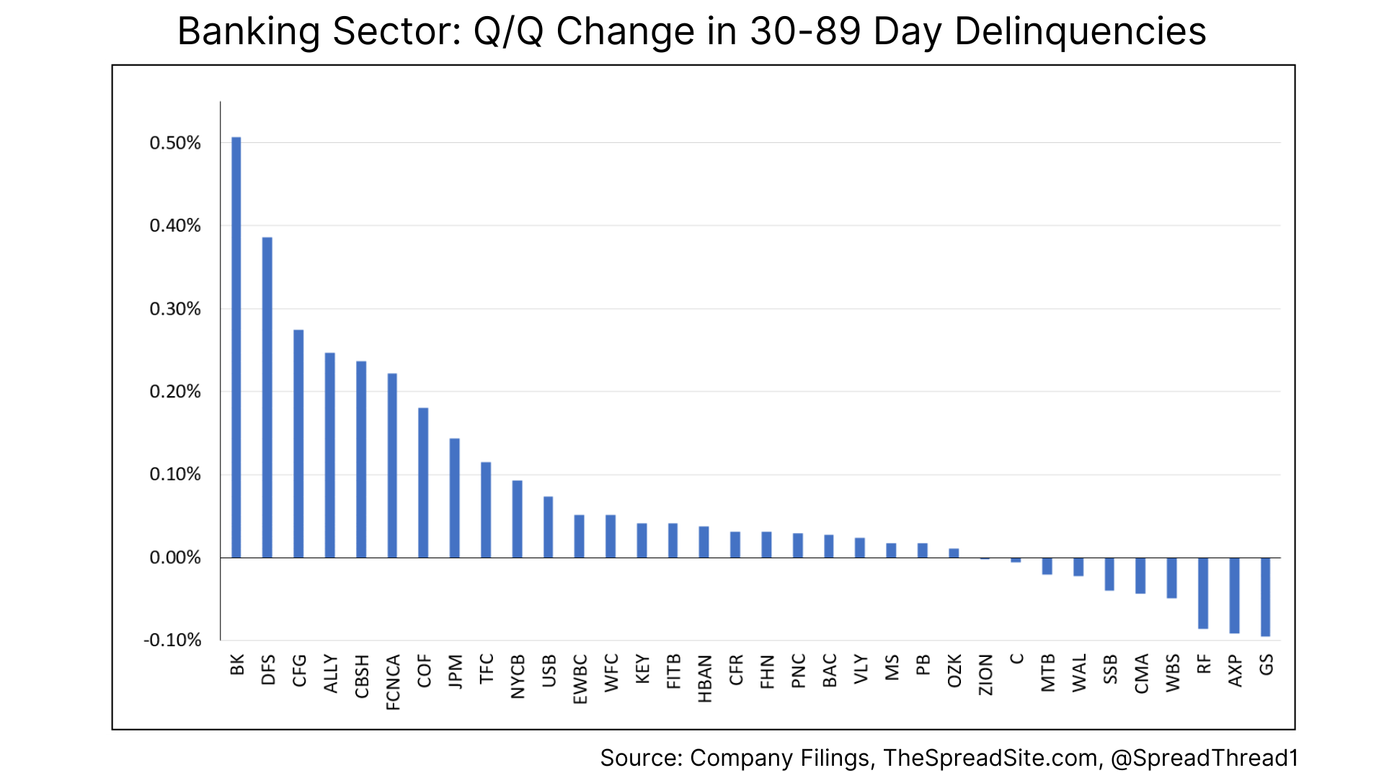

Bank Stocks, Charts & Data: 4Q23 Paid Members Public

The Banking Sector In Charts We are through 4Q23 bank earnings and have a few weeks until all companies file their 10Ks. Aside from a few data points, most information compiled is available through the Call Reports available on the FDIC's website or supplemental data issued with earnings

A Few Thoughts After a Hot CPI Print Paid Members Public

After rallying 22% in nearly a straight line, equity markets finally got a reason to selloff - today’s hot CPI release. A few quick takeaways: First, without getting into all the details, our view is that any one report can be noisy, especially in January, which tends to have

Have a Playbook Paid Members Public

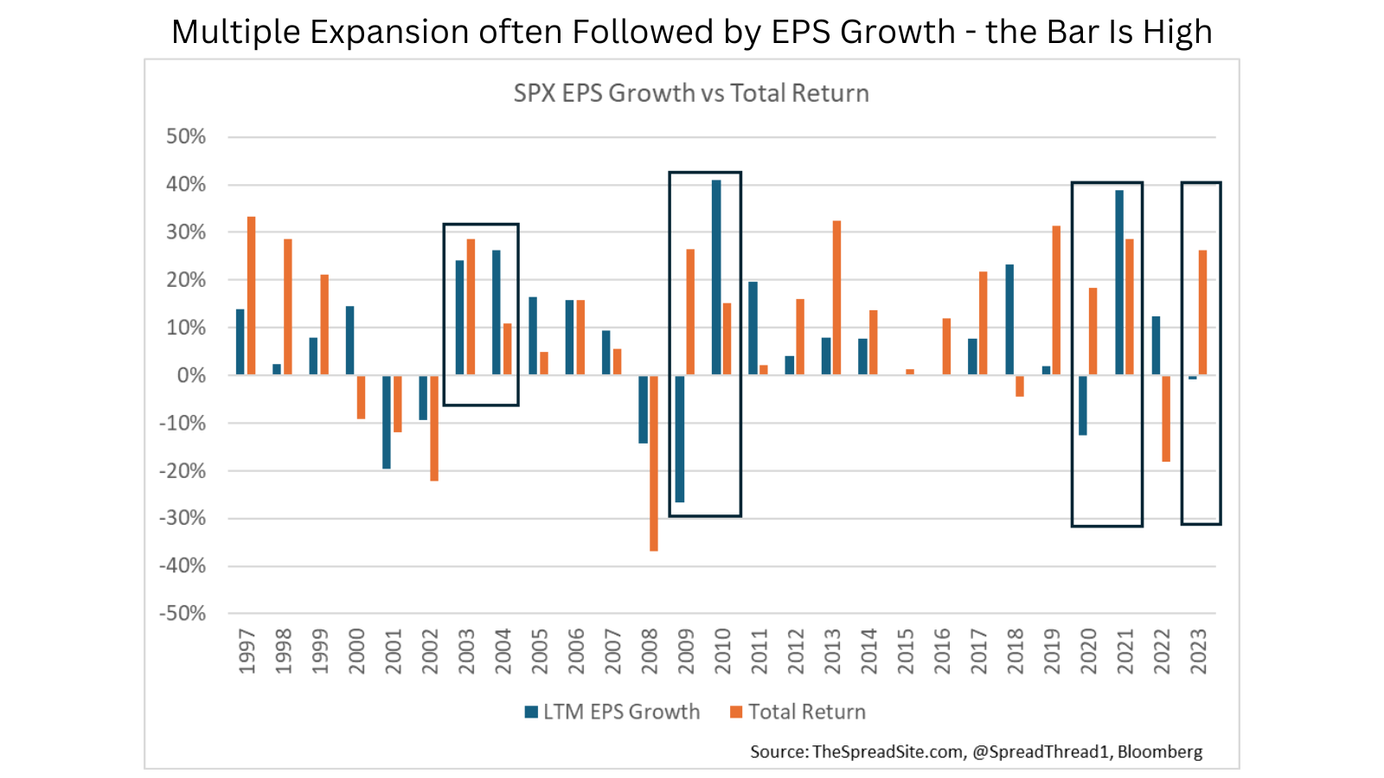

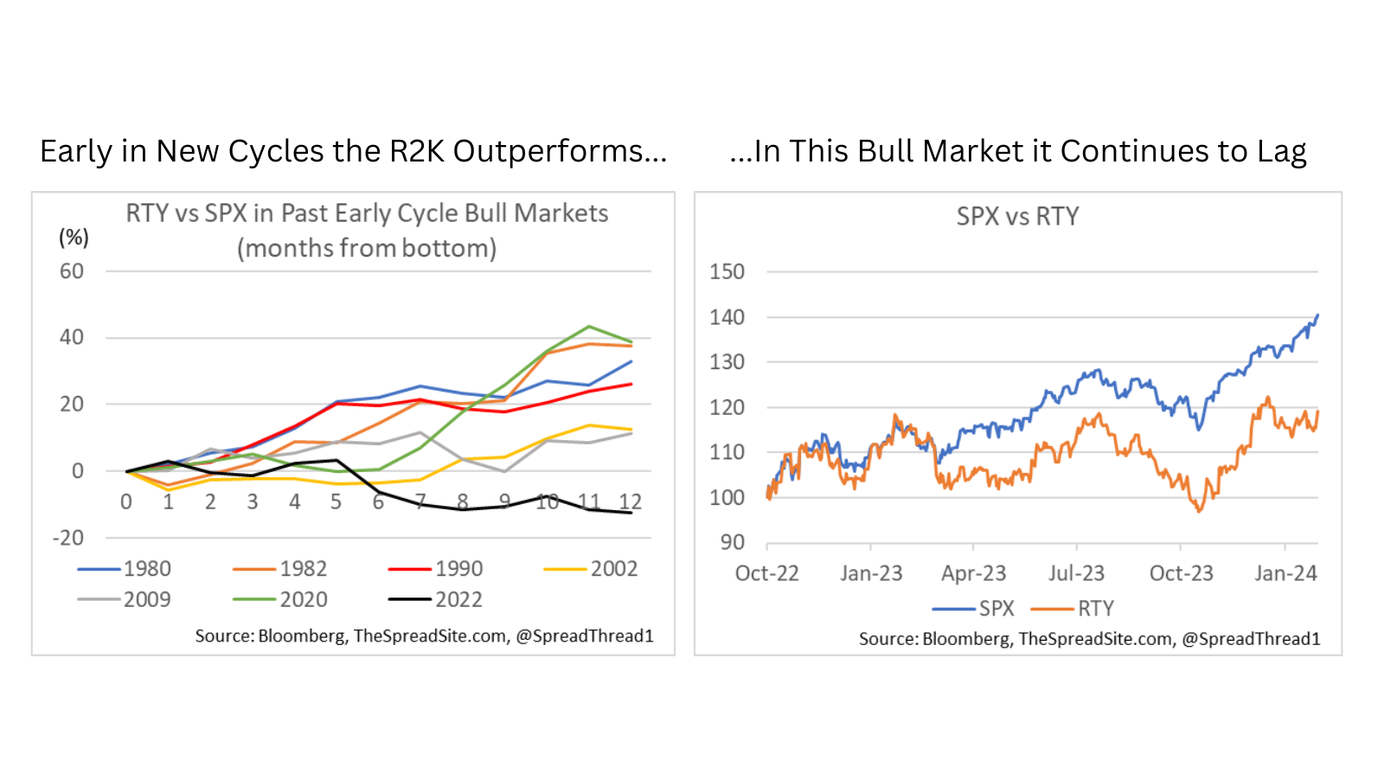

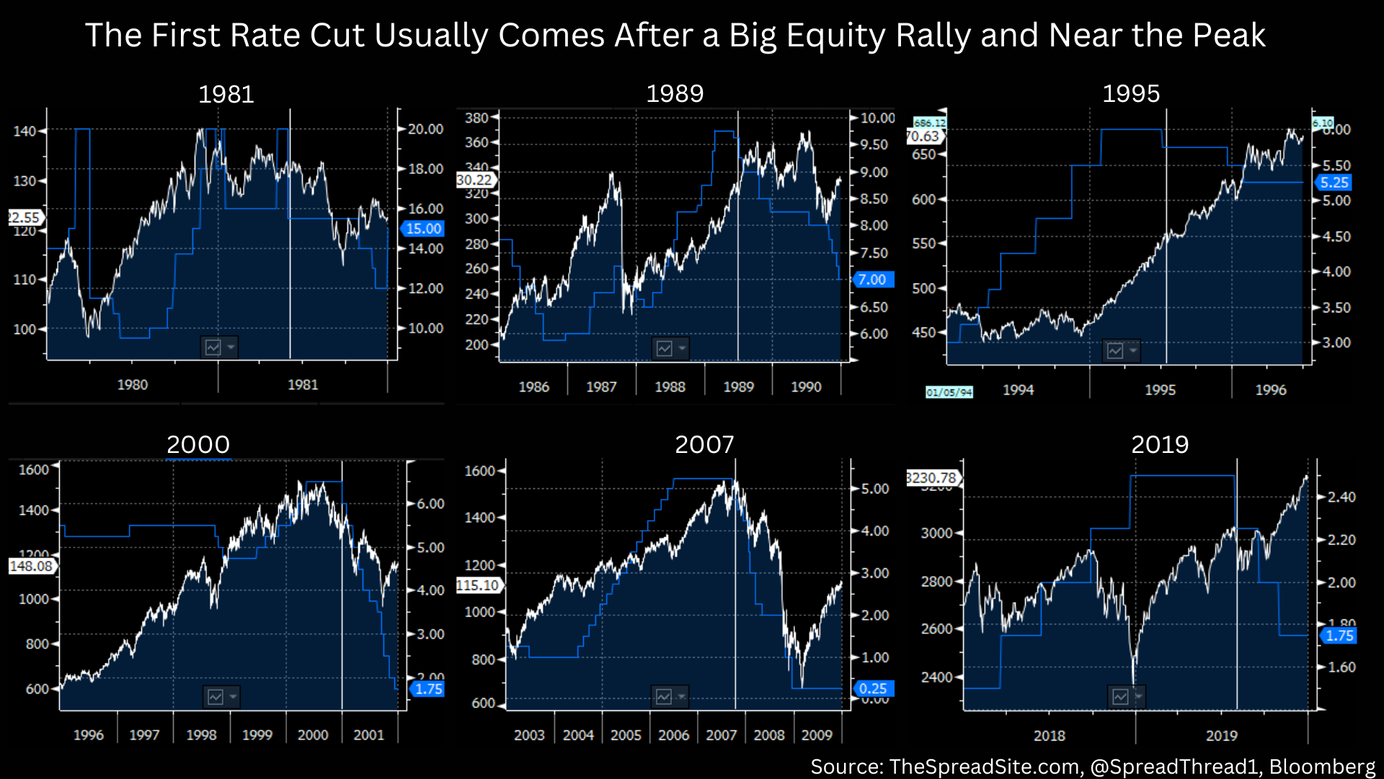

Summary * The market melt up continues, but the drivers have shifted. In Nov/Dec, markets were optimistic around declining inflation, more modest growth, less Treasury supply and this soft-landing optimism fueled a rally in both bonds and stocks. Small caps and banks led and Tech lagged. * Since the start of

Spirit (Airlines) in the Sky Paid Members Public

Summary * We believe the Spirit/JetBlue merger is dead and leaves Spirit facing tough industry fundamentals along with a large $1.1b debt maturity in 2025. Capacity in the domestic air travel market is outpacing demand and rising operating costs are outpacing price increases. * Spirit (and airlines generally) are incredibly

The Case for Gold Miners in 2024 Paid Members Public

Summary * We think gold can outperform this year in various scenarios – for example, if the Fed pushes too aggressively for a soft landing through rapid cuts, or alternatively if employment rolls over quicker than many expect. We like playing the asset class through gold miners, and this report analyzes the

Maybe Not So Different Paid Members Public

* Despite a Goldilocks backdrop now, the key challenge with a soft landing is that it’s tough to keep unemployment at trough levels for long – 3 yrs is the historical max, and we are ~2yrs sub 4% now. In prior soft landings there turned out to be more labor mkt

Front End Corporates Paid Members Public

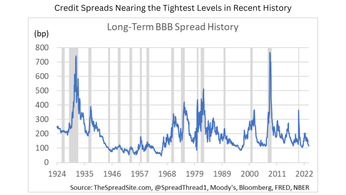

Introduction Markets surged in the last two months of 2023, leaving investors with few attractive options to start 2024. Stocks are off to a bumpy start after the first few days of the year, but still just off all-time highs. Bonds, where we had been bullish, are also less compelling