Zombies Among Us

Summary

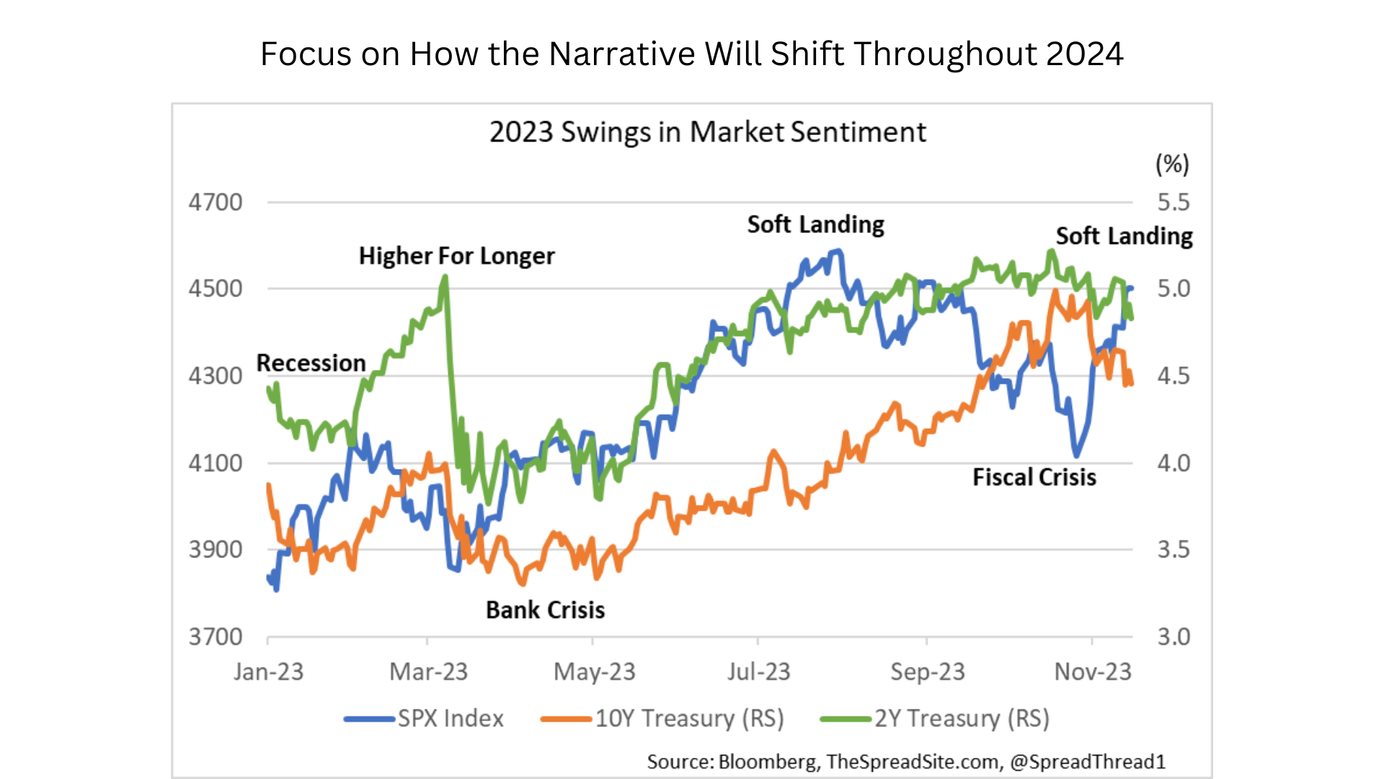

- We continue to see large swings in sentiment in 2023, and it has paid not to get caught up in a narrative for long. Recession-> H4L-> bank crisis-> soft landing-> fiscal crisis. Now back to soft landing. We continue to believe many dynamics today are still inconsistent with historical soft landings. Either way, with just 4 months since the last hike, it is way too soon to declare success or failure.

- The big picture question: Are these rates manageable for enough of the economy long-term. In other words – how much of this economy was only viable in ZIRP, and is only managing due to locked in ZIRP-era funding? While tough to quantify, we think there are more zombies than appreciated.

- A few examples: 1) HY/loans/private credits that have balance sheets built for much lower rates. 2) The many no profit companies thriving in an era of cheap capital. 3) ‘Old economy’ companies that have relied on cheap debt given declining business models. 4) CRE where activity and prices are not close to viable at current funding costs. 5) Some of the spending coming from levered consumers.

- How does this resolve itself? The extreme bull case – strong NGDP driven by strong productivity growth. The modest bull case – a two-tiered economy where the ‘have nots’ are small enough not to drag everything down. The bear case (our view) - the parts of the economy stressed by higher rates pull us down b/c the system is levered and the laggards are big enough to impact spending/ hiring.

Consensus Back to Soft Landing

What a difference 3 weeks and a few soft inflation reports make. Since the low on 10/27 the SPX is up 9%, nearing the late July peak, and 10Y Treasury yields are down ~50bp. Markets are back to the soft landing narrative, with many commentators (and sell side banks) cheering the Fed’s victory – slaying inflation without any material rise in unemployment. While we understand the optimism, and think it could continue for a while longer, we caution about high-fiving too early.

First, we have argued that late cycle environments are bumpy with many swings in sentiment along the way. 2023 has been exactly that, with the consensus shifting from recession, to higher for longer, to banking crisis, to soft landing, to fiscal crisis, now back to soft landing. Along the way, it has paid to NOT get overly caught up in any of these narratives for too long. Rather than trying to time the exact start of a recession, which requires more guesswork than skill, we continue to advise investors to think about how the narrative will change over the next 3-6 months.

Second, much of what we have seen this year is very consistent with late cycle environments – even the rally in markets. Nominal GDP (NGDP) has been high, driven by lingering overheating (high inflation/low unemployment) so policy was pushed further into restrictive territory. Now the hikes are arguably working as intended, with NGDP coming down. Because the decline in growth is modest, which it often is initially, markets are cheering a soft landing. All par for the course. This is why we often see the sharpest rallies at or near the end of hiking cycles, while the curve is inverted, before a recession begins, as we outlined in A Late-Cycle Melt Up

The next stage in the late cycle process is often when NGDP drops below stall speed and ‘Goldilocks’ excitement turns into recession fears. Often at this point unemployment begins rising, non-linearities kick-in, and the market realizes that Fed policy lags work in both directions. Regardless of if/when a recession begins, our guess is that within the next 3-6 months, the market narrative shifts from ‘Goldilocks’ to growth risks and accordingly Fed policy that suddenly seems too tight.

Of course, a soft landing is possible and we understand the optimism around it. We simply think many of the dynamics today look very different from the few that have occurred historically – for example, the sharp tightening in credit conditions, rising defaults/delinquencies, the meaningfully inverted yield curve, and most importantly, the very sharp rise in borrowing costs (from ZIRP) economy wide.

Agree or disagree – it is still way too early to declare victory or failure. The last Fed rate hike was just 4 months ago. And this process can be slow. The most extreme example - in 2006/07 it took 18 months for a recession to begin after the last rate hike. Have patience.

Our bottom line is that the odds of a soft landing are still low, but to pull it off, the Fed needs to be proactive. If Fed policy is bringing down inflation as quickly as recent data MIGHT suggest, then policy is quite restrictive. That means it is only a matter of time until it impacts the labor market in a bigger way. If the Fed waits to cut until negative payroll prints materialize, then it is too late. A hard landing has already begun. Our guess is they will do exactly this – react to not anticipate weakness – given how wrong they were in anticipating a rapid inflation decline in 2021 (i.e., transitory).

The Economy Must Still Contend With Higher Rates

The big picture challenge with engineering a soft landing is in that scenario, the economy would need to fully adjust to current borrowing costs – 7-8% mortgage rates, 10%+ used car rates, 9-10% for levered/smaller corporates, 6% for higher quality borrowers. And yes, these rates might come down modestly if we got ‘surgical’ rate cuts in a soft landing, but likely not by much. At least on the corporate side, credit spreads are already tight, these cuts are now priced in, and the Treasury curve would like steepen in that scenario.

Yes, current borrowing costs have been sustainable so far, but only because much of the economy is not experiencing current market rates, as we have repeatedly argued. That would change if rates remained near current levels for an extended period.

The key question in that scenario: How many zombies are out there? In other words, how much of this economy was only viable in a ZIRP era and is only managing due to locked in ZIRP-era funding?

We believe they are lurking all over the place. A few examples:

- Companies in the HY, loan, and private credit/ private equity markets which have unsustainable leverage for a higher rate environment

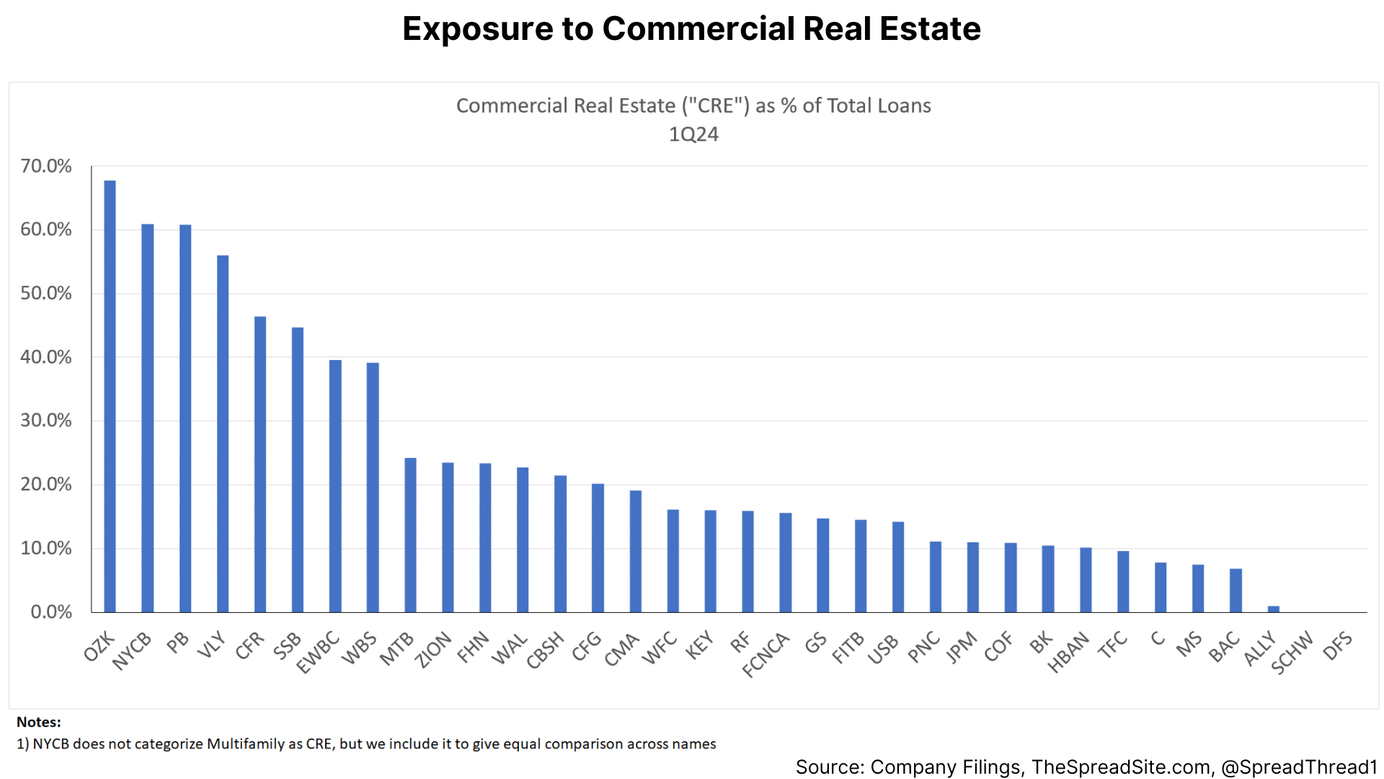

- Commercial real estate activity and prices that are not close to viable at current funding costs

- The many no profit/VC companies that thrived in an era of cheap and easy access to capital

- ‘Old economy’ companies relying on cheap debt given declining business models

- Some of the spending coming from levered consumers - those with high student loan burdens, etc…

While not easy to quantify the ‘zombified’ parts of this economy, a few high-level numbers below as a starting point.

The first exhibit points out that the median operating cash flow/ debt for B- rated companies was around zero, leverage near 9x, and interest coverage sub 2x, PRIOR to this rate hike cycle when the yield in the loan market was ~4%. Today ~25% of B- rated borrowers have interest coverage below 1x.

And we note B- and below is now about 40% of the leveraged loan market, not an insignificant number.

Similarly private credit issuers in FSK’s (KKR’s public BDC) portfolio (a proxy for the broader asset class) had around 2.5x interest coverage on average at the beginning of 2022. Though we don’t have the full breakdown beyond these medians, this likely means a reasonable portion were barely covering interest costs again prior to the rise in rates over the past few years. Now median interest coverage for this universe is down to 1.5x.

As we showed in The Haves and Have Nots, the bottom 20% of Russell 3000 companies have negative EBITDA. The next 20% have near zero EBITDA. Presumably a decent share of these companies are or will be reliant on cheap capital going forward.

Lastly, below we show that at current borrowing costs, a typical new multi-family development would have zero free cash flow.

These are just a few examples. No doubt very low rates have permeated through this economy in many ways that are not easy to quantify. That said, this dynamic doesn’t have to end in a catastrophe. Higher rates and less central bank involvement may be a very healthy development longer term – less misallocation of capital, at the least. But the question is the path to get from here to there.

To state the obvious, the zombies won’t all go bankrupt, even if rates remain this high or rise from here. They will just have a tougher time ‘playing offense,’ which is a drag on the economy. Some will be able to successfully restructure businesses which will involve spending cuts, others will restructure debt, and many will go away.

Bigger picture, there are multiple potential paths for the economy as well – three possibilities outlined below:

- The extreme bull case is that growth/ earnings remains strong enough to offset higher rates, driven by solid productivity growth, so that a resurgence in inflation does not push us back to square one.

- The modest bull case is a two-tiered economy where the zombies are small enough not to drag everything down, and the ‘haves’ (consumers with healthy balance sheets, large-cap tech and the like) are big enough to keep the economy bouncing above zero.

- The bear case is that the parts of the economy stressed by higher rates do pull us into a recession because the system is very levered/interconnected and the laggards are big enough to impact spending/ hiring. As just one example, below we show the number of people employed by companies in the high yield and leveraged loan indices, just a portion of levered businesses in this economy.

Ultimately, we think #3 above is still the highest probability scenario because 1) ‘this time is rarely different’ – tightening cycles usually end in recession, especially inflationary cycles, and we are just 4 months past the last hike. The odds are still on our side. 2) Dynamics discussed above are not consistent with a soft landing, in our view, bullish sentiment aside. 3) Most importantly, we struggle to see how such a sharp rise in borrowing costs after a decade of ZIRP does not come with a larger macro adjustment than what we have already seen.

But of course, we will continue to keep a close eye on markets for signs the probabilities are shifting. For now, we stick with our larger macro views.

Disclosures

Please click here to see our standard Legal Disclosures

The Spread Site Research

Receive our latest publications directly to your inbox. Its Free!.