Recent Posts

The latest research content from TheSpreadSite.com and @TheSpreadThread1

Corporate Credit Primer Paid Members Public

We put together a primer on corporate credit markets designed for someone with a low-to-moderate understanding of credit. We touch on most topics, at a high level, that we believe are important to understand when investing in the asset class. In future primers, we will dig into some of the

Ford and GM: Cheap For a Reason Paid Members Public

Summary 1. Recent share price underperformance for Ford and GM is driven in part by a cost structure that is moving structurally higher after recently signing a new UAW labor contract. In addition, while each company is transitioning to higher electric vehicle (“EV”) production, fundamentals in this segment are softening,

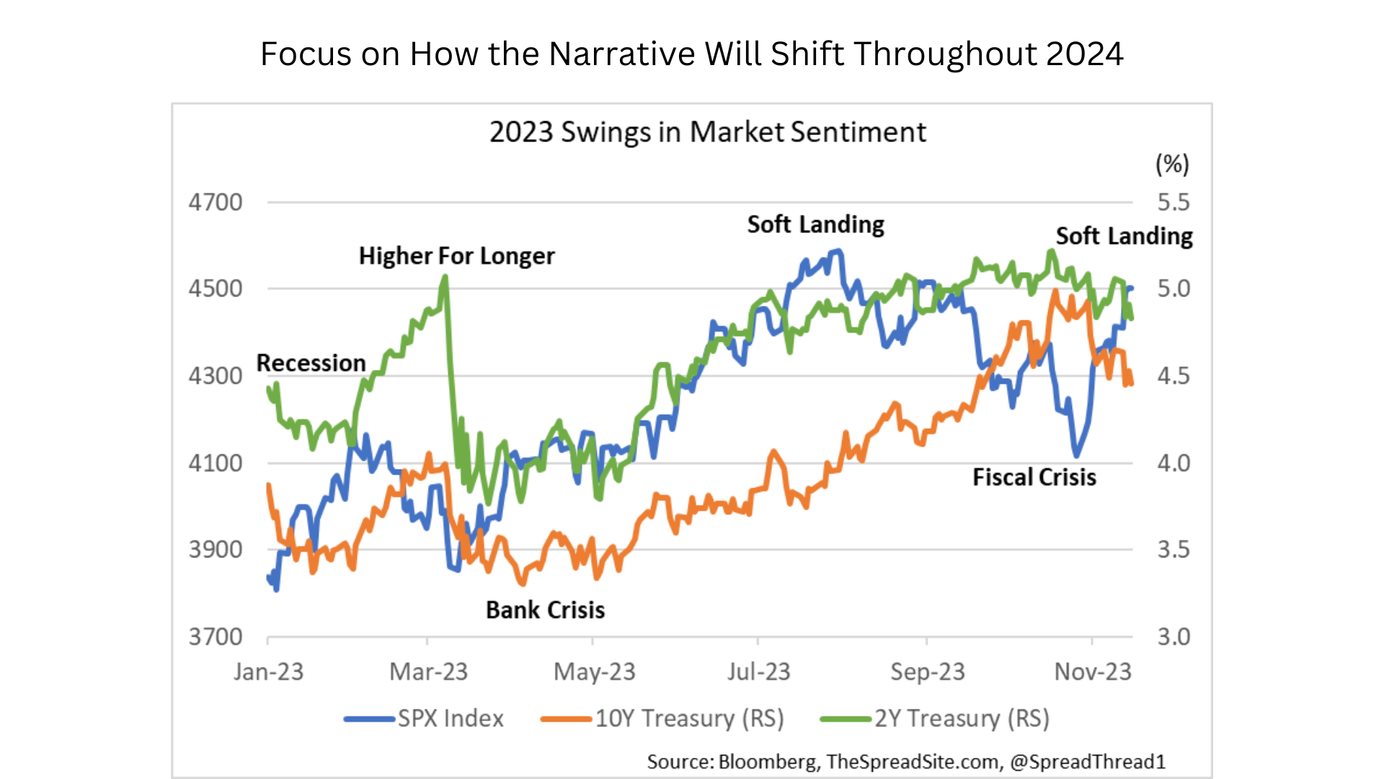

Zombies Among Us Paid Members Public

Summary * We continue to see large swings in sentiment in 2023, and it has paid not to get caught up in a narrative for long. Recession-> H4L-> bank crisis-> soft landing-> fiscal crisis. Now back to soft landing. We continue to believe many dynamics today are

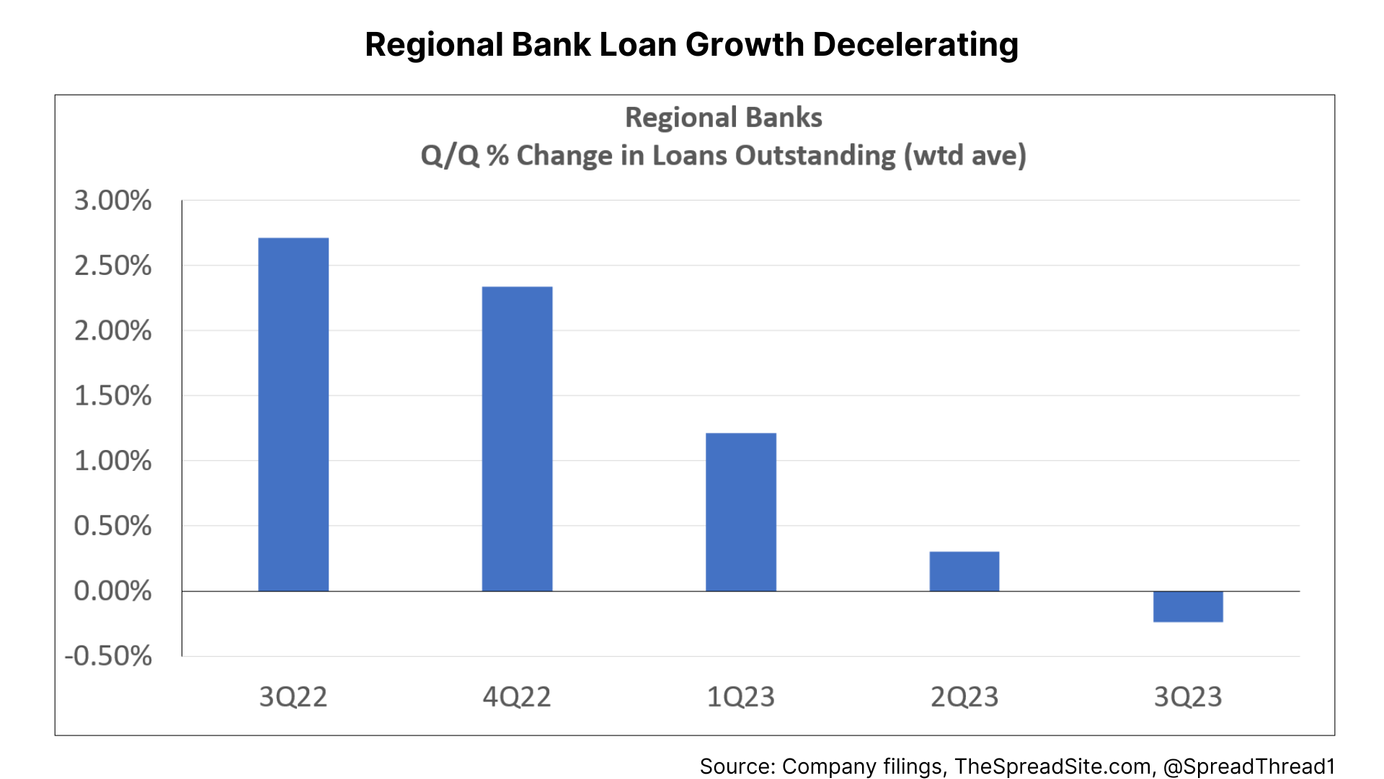

Bank Stocks, Charts & Data: 3Q23 Paid Members Public

The Banking Sector In Charts We are through 3Q23 earnings and all companies have filed their 10Qs. We present fundamental data across the sector, in chart form. Our method, generally speaking, is to include all banks in the "KRE" Regional Bank ETF greater than ~$5b of market cap

Agency Mortgage REITs: Leveraging An Attractive Asset Paid Members Public

Summary 1. Rising rates in addition to elevated interest rate volatility have led to a widening in agency MBS spreads and significant declines in book value within the agency mortgage REITs. We think that presents an attractive buying opportunity. We walk through the mREIT business models in detail. 2. We

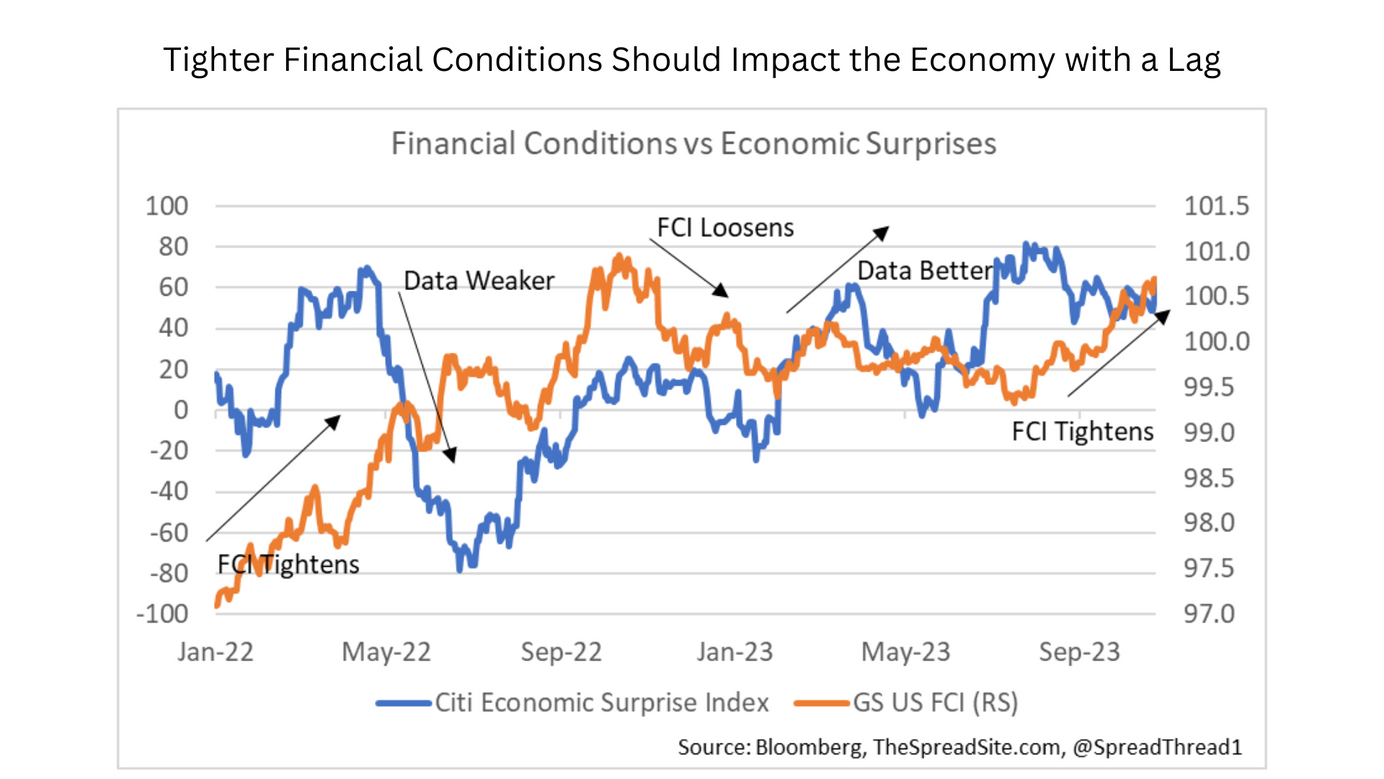

Financial Conditions Tightening Paid Members Public

Summary * The key question today: Was growth in 3Q23 a temporary bounce in a bumpy late-cycle economy, or a more durable re-acceleration? We remain in the former camp and think markets are also looking beyond 3Q with economically-sensitive sectors hit hard since late July. Ultimately it comes down to how

Classifying Closed End Funds Paid Members Public

Introduction Closed End Funds (“CEFs”) offer investors different ways to take advantage of the recent rise in interest rates, especially as Net Asset Value ("NAV") discounts widen. We recently published a primer on CEFs (Closed End Funds: An Overview, Risks and Opportunities) for those looking to learn more

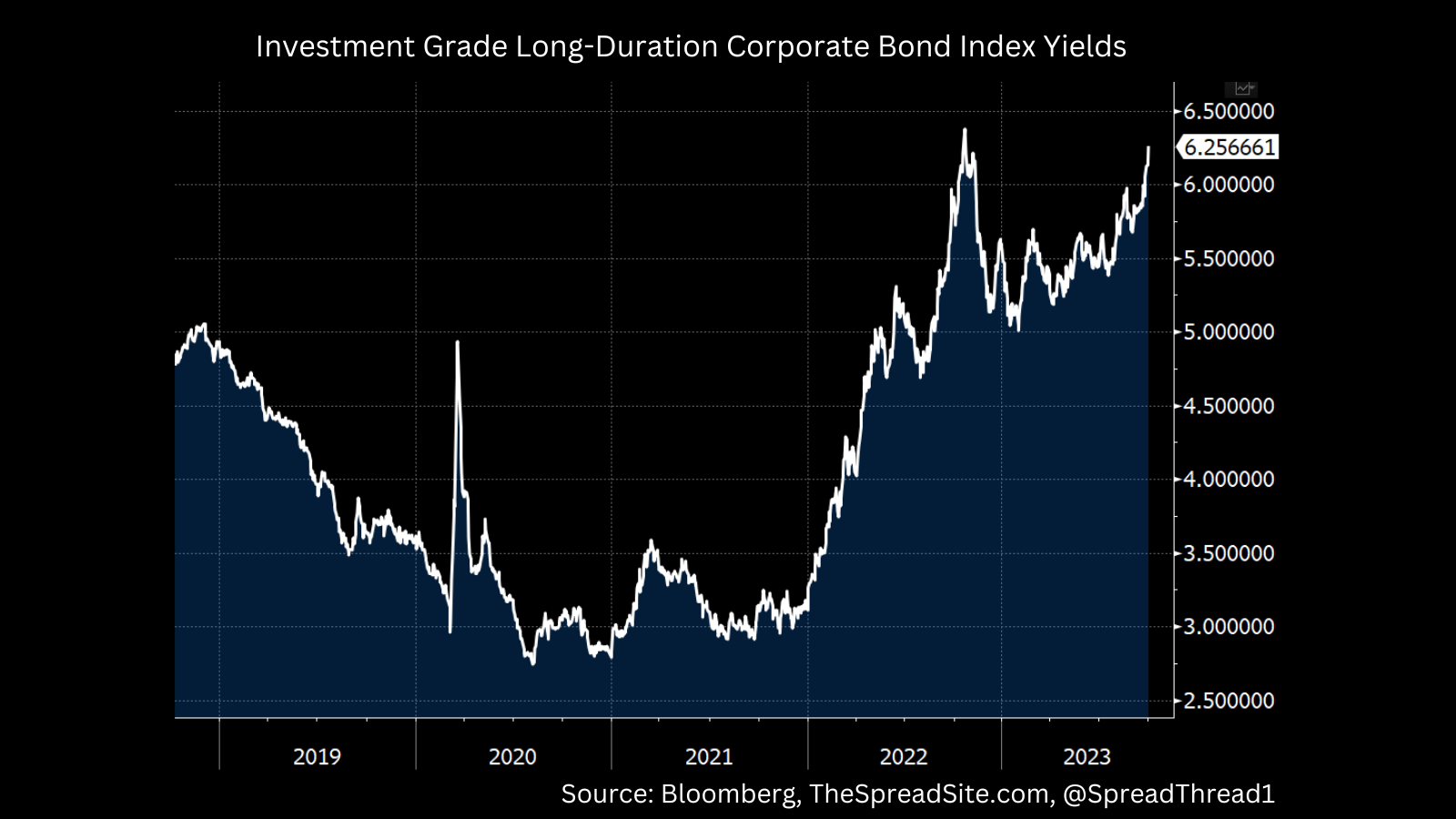

A Below Par Report Paid Members Public

Summary * Given this spike in rates over the past few months, a meaningful portion of corporate credit now trades at deeply discounted prices, which matters for valuations. In this week’s report, we walk through how to quantify the fair spread differential for high vs low dollar priced corporate bonds.