Company Analysis

Fundamental analysis on sectors, stocks and corporate bonds

Ford and GM: Cheap For a Reason Paid Members Public

Summary 1. Recent share price underperformance for Ford and GM is driven in part by a cost structure that is moving structurally higher after recently signing a new UAW labor contract. In addition, while each company is transitioning to higher electric vehicle (“EV”) production, fundamentals in this segment are softening,

Agency Mortgage REITs: Leveraging An Attractive Asset Paid Members Public

Summary 1. Rising rates in addition to elevated interest rate volatility have led to a widening in agency MBS spreads and significant declines in book value within the agency mortgage REITs. We think that presents an attractive buying opportunity. We walk through the mREIT business models in detail. 2. We

Classifying Closed End Funds Paid Members Public

Introduction Closed End Funds (“CEFs”) offer investors different ways to take advantage of the recent rise in interest rates, especially as Net Asset Value ("NAV") discounts widen. We recently published a primer on CEFs (Closed End Funds: An Overview, Risks and Opportunities) for those looking to learn more

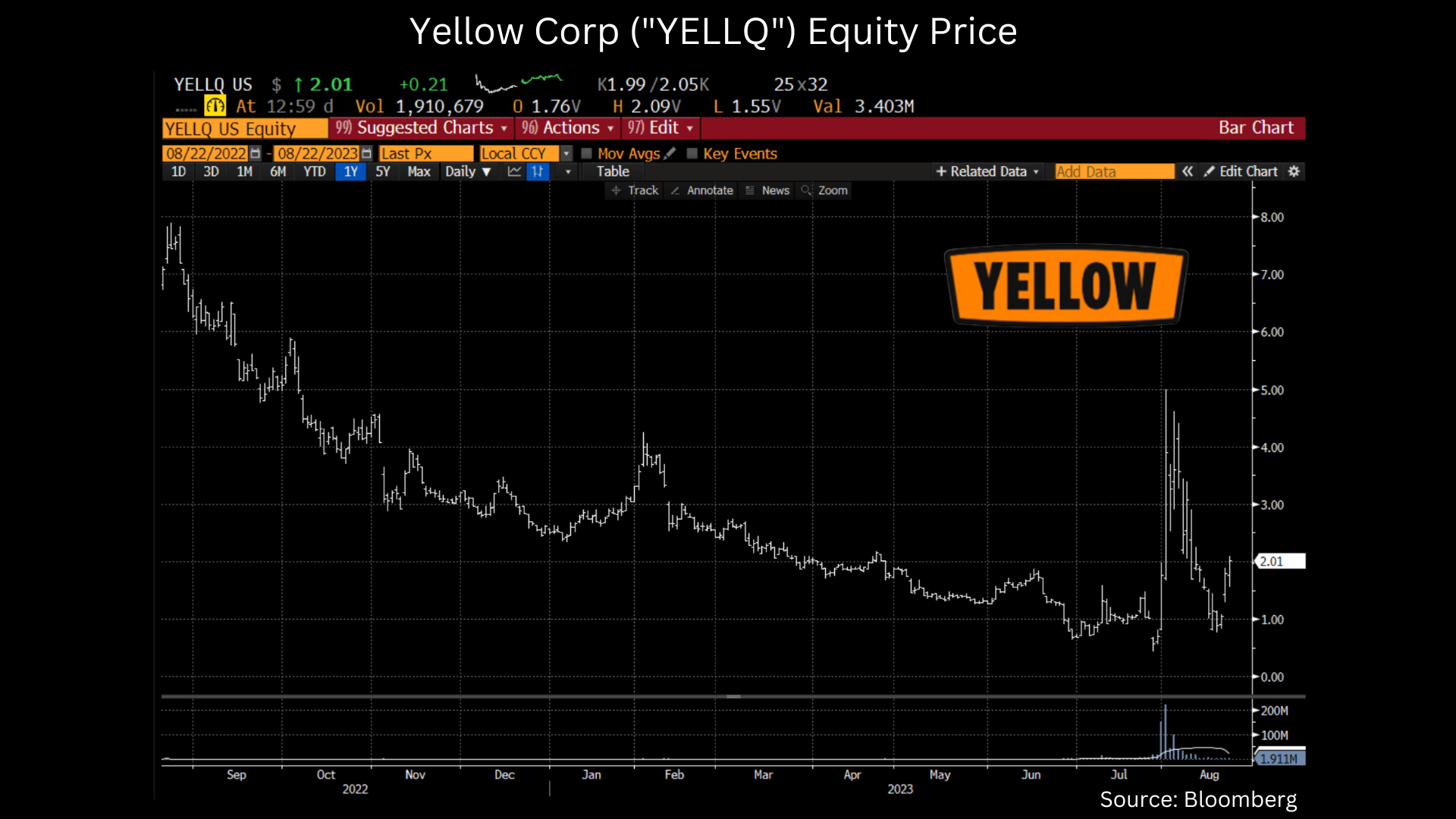

Yellow Corp ("YELLQ"): A Ch.11 Liquidation With Multiple Moving Pieces Paid Members Public

Chapter 11 & Pre-Petition Equity On August 6, 2023, Yellow Corporation filed for Chapter 11 under the US Bankruptcy code, case# 23-11069. For case information, a list of advisors, and all public documents you can visit the case management website here. Given a long history of liquidity and union problems

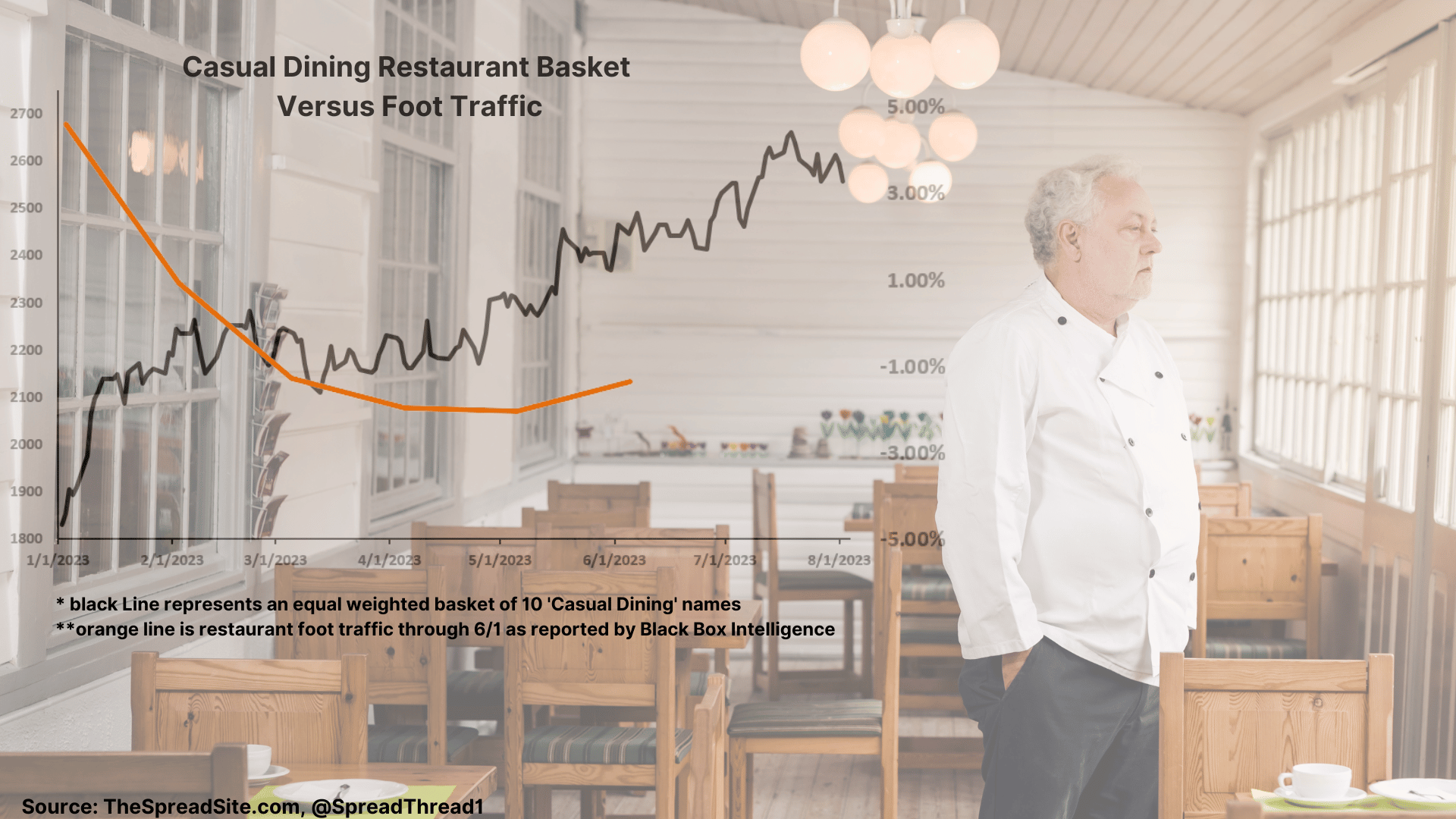

Restaurant Stocks to Face Macro Headwinds Paid Members Public

Summary * The service economy has been resilient, supporting stocks catering to consumer ‘experiences.’ We think several macro headwinds could change those dynamics. This week’s note provides an overview of the restaurant sector and a long/short basket to play this theme. * Student loan repayments are set to resume this

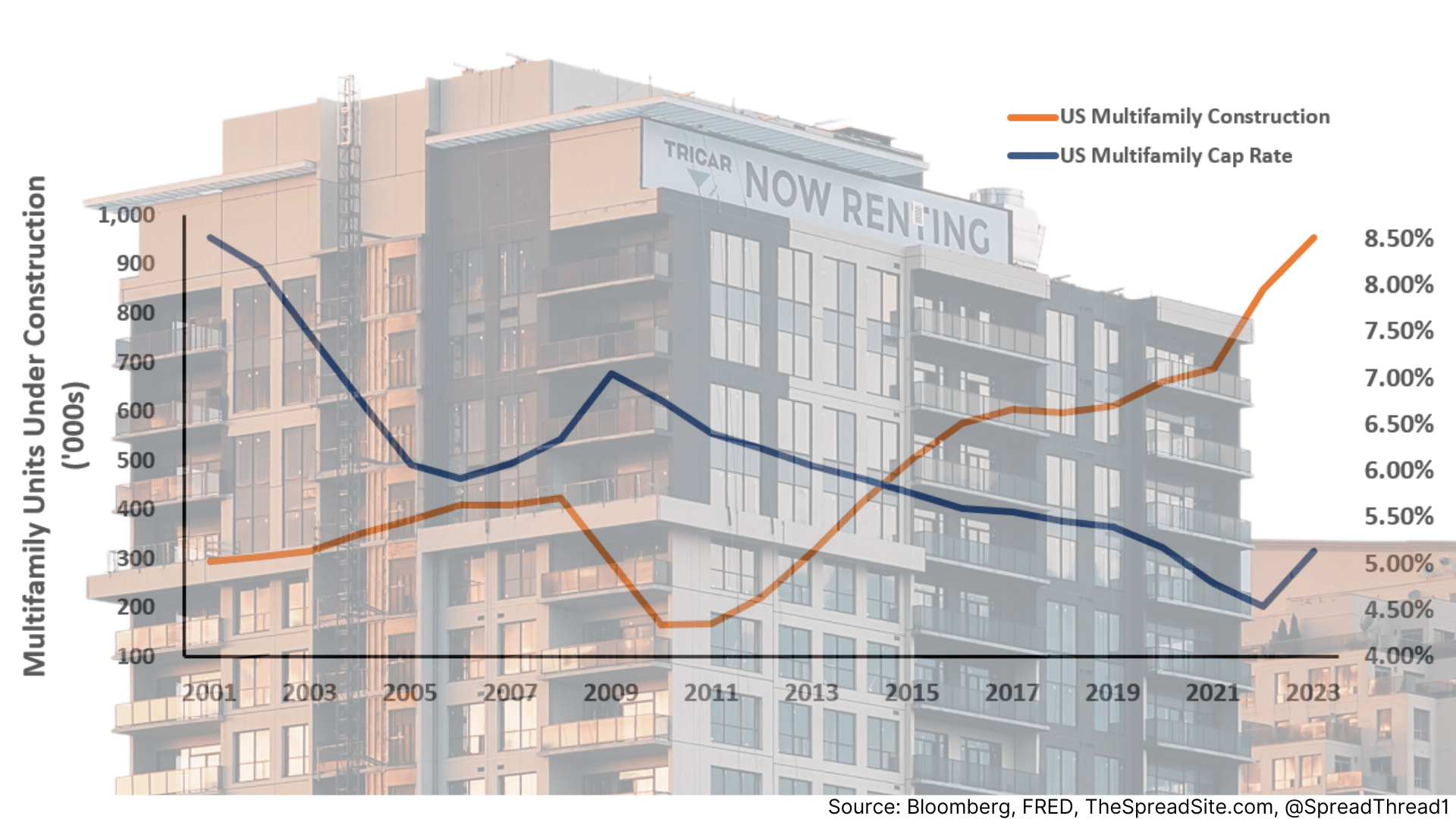

Everyone's Starting a Multifamily Paid Members Public

SUMMARY * The current risk/reward for multifamily ("mFam") REITs is unattractive given our view that rent growth and vacancies will worsen, cap rates are too tight, headline risk for CRE in general is elevated, and higher fixed income yields mean better alternatives for yield-focused investors. * Macro headwinds include