Duration On Sale

Summary

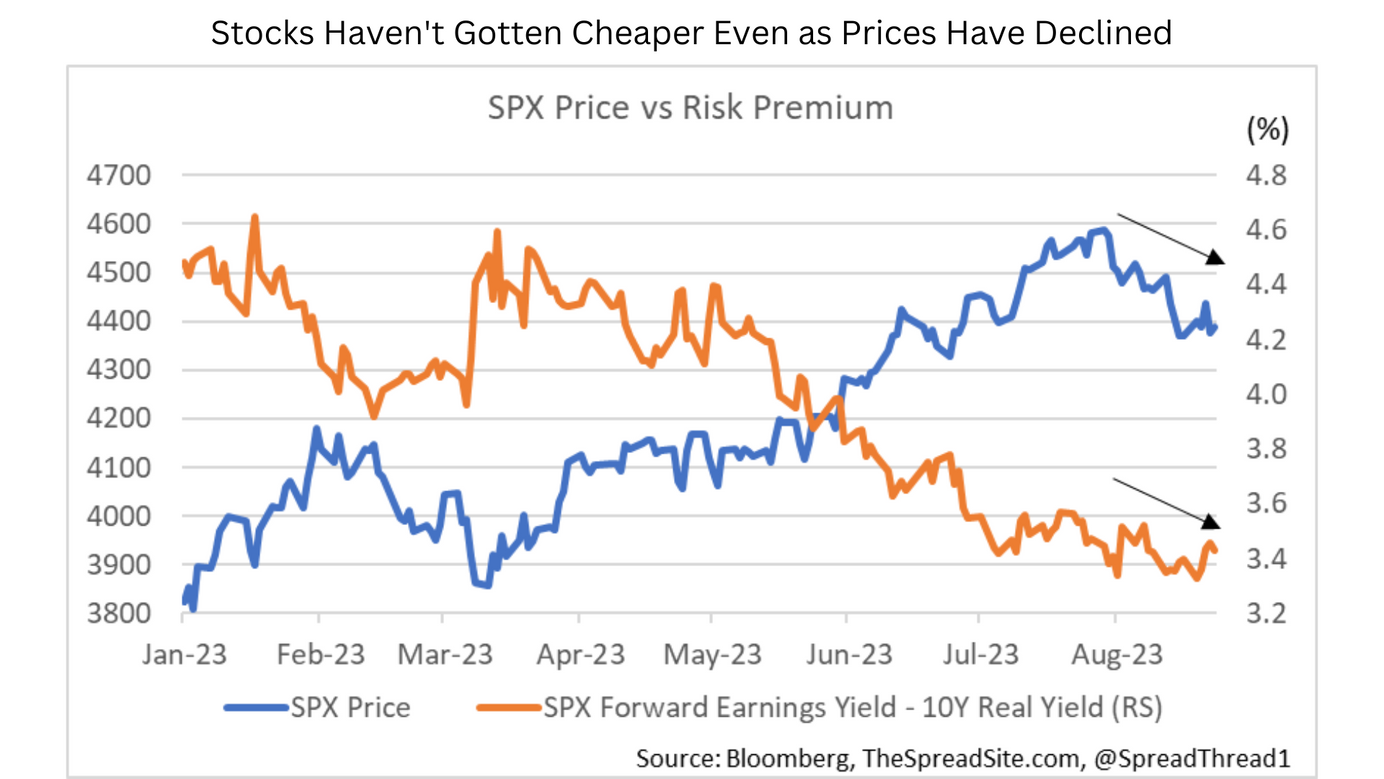

- The equity market is arguably becoming MORE overvalued vs bonds, even as prices fall, because rising rates are offsetting lower P/Es. That said, we think stocks will ultimately need to see the impact of those higher rates (i.e., slower growth/ lower earnings) before declining in a much bigger way.

- Bond technicals have clearly been poor and that could lead to an overshoot. But we think the fundamental drivers that many cite for significantly higher bond yields are likely to disappoint vs what is now in the price, especially the growing consensus behind an accelerating economy.

- A bear steepening in Treasuries usually occurs as the Fed is cutting rates or when the Fed Funds rate is near cycle lows. A late cycle bear steepening rarely persists. Once the Fed has completed a hiking cycle (thus policy is restrictive), the ability to withstand a further increase in borrowing costs is limited.

- Trying to time when bond yields peak is beyond our pay grade. But we are confident that with this rise in rates, yields for high quality fixed income stand out as at least relatively cheap vs very tight credit spreads and elevated stock valuations. We detail several investment ideas along these lines.

Stocks Not Getting Cheaper

The first notable pullback in the equity market (-5% from the highs at time of writing) since this past Feb/Mar is underway, with stocks once again paying attention to bonds. Of course, the problem with higher Treasury yields driving lower stock prices is that while P/E multiples are compressing, the risk premium in the market is still declining. In other words, the equity market is arguably becoming modestly MORE overvalued, even as prices fall. To provide some crude math, at the peak on 7/31 the SPX traded at a 508bp earnings yield (19.7 p/e). Currently, the SPX is trading at a 538bp earnings yield (18.6 p/e). That means the earnings yield has risen by 30bp. However, over the same period, 10Y real yields are up by ~40bp, so the equity risk premium has fallen by ~10bp. At the least we can say stocks have richened vs bonds during this pullback.

That said, we are skeptical Treasury yields alone will be the factor to break the equity market, unless the rate move becomes disorderly. In our view, markets ultimately need to see the impact of those higher rates. As long as earnings estimates are rising, the macro data is inline, and inflation is not re-accelerating, it is easy to argue that these rate levels are manageable. Once earnings estimates turn lower, consumer weakness becomes more notable, and especially if/when the labor market cracks, that narrative will crumble. A 19-20 p/e on stocks with falling earnings estimates won’t be sustainable. At that point we think markets will react in a bigger way.

Fundamentals Favor Bonds

How are we thinking about this bond move? In short, technicals have clearly been poor and that could drive an overshoot. But we do think the fundamental drivers that many cite for significantly higher bond yields are likely to disappoint vs what is now in the price. Most importantly, regardless of when yields peak, we now see value across high quality fixed income for medium-term investors, especially relative to the alternatives.

Digging into the details. Bond yields have been rising for various reasons. First, the consensus has clearly moved away from hard landing, increasingly in the camp that the economy may be reaccelerating. And along these lines, the belief that the long-term neutral rate (r*) may now be higher is also likely having an impact. Second, significant Treasury supply, combined with ongoing QT is also pressuring yields. And third, external factors such as the Bank of Japan adjusting its YCC may be suppressing global demand for Treasuries.

In our view, just as the market was too confident in an imminent recession at the start of the year, we think it is now way too confident that growth is about to take off. We would not be surprised if the relentless citing of a ~6% Atlanta Fed GDP forecast marks the “top” in this acceleration narrative. Without getting into the details, we think it is very unlikely the cyclical parts of the economy can accelerate with borrowing costs highly elevated and rising. Below we show earnings commentary so far across retailers reporting over the past week or so. The commentary does not show a consumer falling off a cliff, but it does show a consumer that is challenged, especially at the low-end. And this is before many of the headwinds that we have discussed in detail (i.e., student loan repayments, fading fiscal stimulus, lackluster global growth, the rate hike lag, etc…), hit harder as the year progresses.

Importantly, given how much macro optimism has risen, we think bonds no longer need a recession to catch a bid. They just need some mean reversion in economic surprise indices, which outside of the post-Covid boom, are near the highs.

Beyond economic expectations built into markets, the other drivers of higher bond yields are a bit tougher to handicap. For example, there are wide-ranging views on whether/how much Treasury supply impacts yield levels. We do think it has an impact. How much, we don’t know. But in our view, the idea that deficits of this size or larger will continue indefinitely has become consensus. While we would certainly not argue that policy makers will adopt religion around fiscal discipline anytime soon, we do think the ability to enact bazooka-sized fiscal stimulus won’t be as easy as some think going forward. Additionally, it is likely the fiscal boost in 1H23 is not going to be repeated in the near term for more technical reasons (to discuss at another time).

Either way, we believe many have conflated the interest rates necessary to bring down growth/inflation fast (in part because of all the stimulus that has been stuck in the system) with the long-term interest rates this economy can withstand. In our view, the latter has not changed as much as many believe and that will become increasingly clear over time as a greater number of consumers/corporates are forced to borrow/refi at prevailing market rates.

Bear Steepener Unsustainable

It is also important to remember that this rise in rates is happening late in a cycle, and at least for the past month is no longer being driven by front-end yields moving up – the curve has started to bear steepen (i.e., long-end yields rising fastest).

Why does this matter? In the table below, we list all the bear steepening episodes back to the late 1970s. As the exhibit shows, a bear steepening in the Treasury curve almost always occurs as the Fed is cutting rates or when the Fed Funds rate is at cycle lows. In a sense, the bear steepening is the markets way of saying that growth is about to improve as a result of the rate cutting cycle that just occurred. There are very few late-cycle (after the Fed has hiked) bear steepening episodes, and those that have occurred, typically don’t last. We think the rationale is fairly clear. Once rates are already high and the Fed has completed a hiking cycle (thus policy is restrictive), the ability of the economy to withstand a further increase in borrowing costs is limited.

This time could be different for various reasons. For example, the extent of the inversion in the Treasury curve could mean it is easier to bear steepen than in the past. But our sense is that this late-cycle bear steepening episode will fizzle out when growth begins to disappoint- not too far in the future.

Value Emerging in Bonds

Trying to time when bond yields peak for this cycle is beyond our pay grade. But we are confident that with this rise in rates, yields for high quality fixed income stand out as at least relatively cheap vs very tight credit spreads and elevated stock valuations. And note, as the Treasury curve bear steepens, longer duration fixed income becomes relatively more attractive vs even cash, so the rationale for “T-Bill and Chill” (vs moving out the curve) becomes less compelling.

We end with a few quick examples of areas within high quality fixed income where value is being created by this rise in rates. We will expand on some of these in future reports.

First, long duration Treasury bonds near/above the prior Oct ’22 peak we think offers value. In particular, real yields at the long-end anywhere near 2% this late in a cycle, we believe are particularly cheap.

Second, the MBS market is another form of high-quality yield that offers value, in our view, also with wide spreads, unlike the corporate credit market. Investors can buy the mortgage index at a yield-to-worst of near 5.25% through various ETFs (MBB, VMBS).

Third, for those who want some leverage to higher rates, the closed end fund (CEF) market offers some opportunities. In this space, investors need to be more careful, because these funds are levered and less liquid. We plan to do more work on CEFs, but one example is the Blackrock “Taxable Build America Bond” CEF (“BBN”) where you can get a weighted average YTM of 5.9%, 9.5 years of duration and a discount to NAV ~8% (excluding the effects of leverage).

Lastly, while we are generally cautious on credit because of tight spreads and our view around the credit cycle Cycle Through the Noise, we do think high quality, long-duration IG offers some value (looking at all-in yields), especially if a recession takes longer to materialize than we expect. But we would avoid reaching for yield in riskier credits both within IG and HY, at least until recession risks get priced back into the market. As an example, below is a basket of high quality (A rated or above, lower leverage sector-adjusted, non-financial, large issue size) longer-duration corporate bonds. Yes, spreads here are tight. But these are mostly best-in-breed balance sheets- the type of companies that should outperform in a downturn.

Disclosures

Please click here to see our standard Legal Disclosures

The Spread Site Research

Receive our latest publications directly to your inbox. Its Free!.