A Few Thoughts After a Hot CPI Print

After rallying 22% in nearly a straight line, equity markets finally got a reason to selloff - today’s hot CPI release. A few quick takeaways:

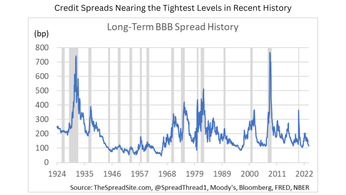

First, without getting into all the details, our view is that any one report can be noisy, especially in January, which tends to have the biggest issues with seasonal adjustments. We would be careful jumping too quickly to the conclusion that inflation is about to take off again. That said, we also can’t dismiss this datapoint, as it is clearly important for markets. Economic data has been positively surprising of late. Odds have increased that inflation could settle at an uncomfortable level for the Fed, and as a result, they may have to dial up the hawkish rhetoric. However, we are still not as confident as others that the disinflation trend is reversing in a sustainable way. At the least, we want to see a few more months of data. Remember, head fakes are the norm in this cycle. Front-end bonds sold off hard last Jan/Feb on similar ‘no-landing’ concerns, only to reverse course fast when SVB (etc…) hit markets in March.

Second, markets were due for a pullback, and this CPI surprise is a perfect excuse, especially as the last few weeks of February are one of the weakest seasonal periods of the year. However, we would be surprised if this inflation scare is worth much more than 5%-7% on the SPX. So far this year, Treasury yields have risen and it hasn’t hurt equities because it has coincided with stronger growth expectations. For now, we think investors will stick with the narrative that yes, hotter data may lead to fewer cuts, and modestly higher yields, but markets can take it because the economy is solid. So likely a digestion period in risk assets, but not a material drawdown.

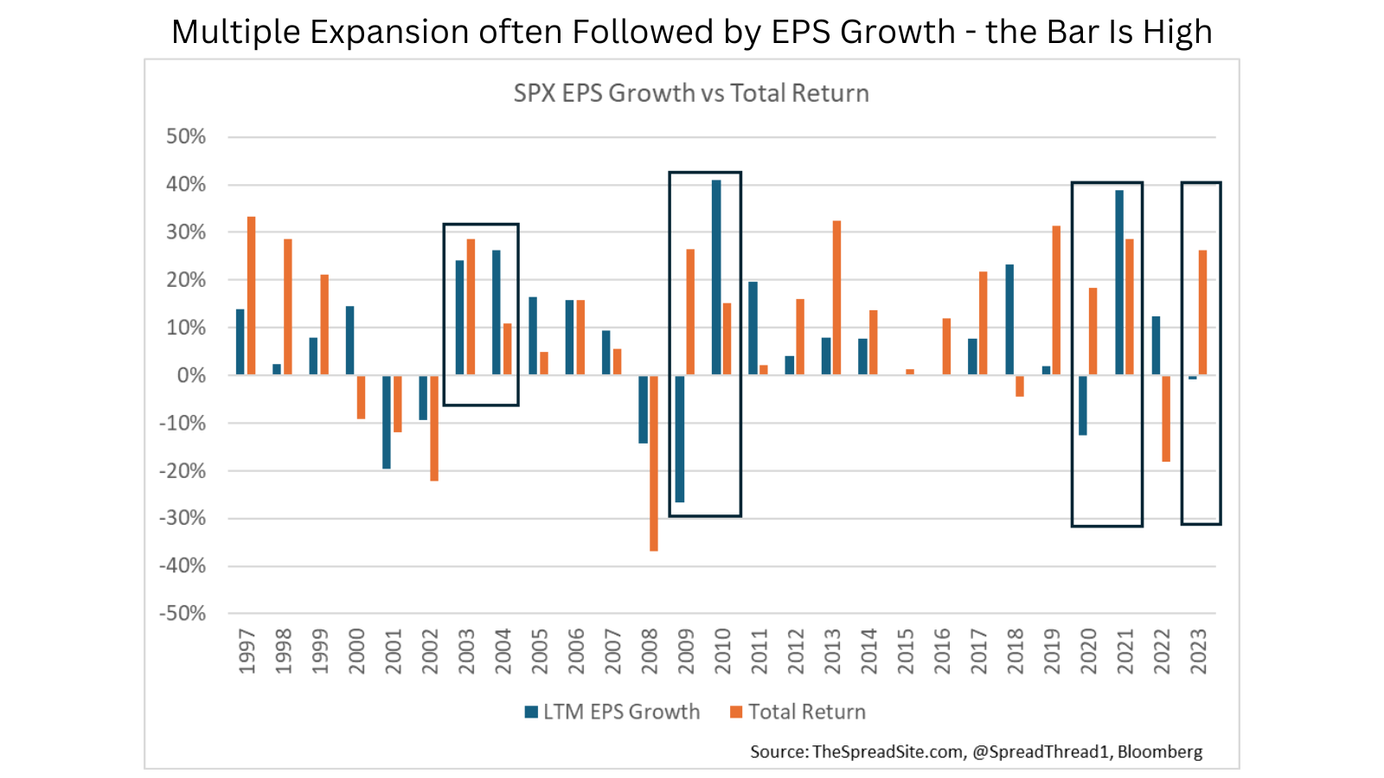

Obviously if the rate rise accelerates, or if stronger growth expectations start to coincide with fears of a material acceleration in inflation, that can change. We still think the bigger medium-term risk is growth and earnings. Specifically, the SPX is now trading above a 20x p/e multiple. Stocks returned 26% in 2023 and EPS growth was negative (-1%). The rally was all multiple expansion.

It is normal for the first year of a new bull market to be driven by multiple expansion with strong EPS growth the following year. But these new bull markets often come after recessions when earnings get hit hard and companies dramatically cut costs/labor. This sets the market up for V-shaped earnings growth – easy comps and solid operational leverage. Now, markets are pricing in strong EPS growth, but without the same low bar that typically follows an earnings/economic recession. At some point, if markets have to adjust to much weaker EPS, downside is material given starting valuations. Again, we think this is a bigger risk to stocks, especially late in a cycle, than pricing out a handful of rate cuts.

For now, we stick with the playbook laid out last week Have A Playbook which seems to be working today (shown below). Markets are more aggressively pricing in a ‘no landing’ scenario, and as a result, bond yields are rising and the curve is bear flattening. And at the time of writing, small caps (-3.93%), banks (-4.6%), retail (-3.43%), and homebuilders (-3.63%) are underperforming large cap tech (-2.17%), energy (-1.51%) and industrials (-1.55%). We aren’t making any moves today. Bond yields have broken out of the recent range so we are waiting. We would add more aggressively to TIPs if long-end real yields make it back into the 2.3%-2.4% range.

Disclosures

Please click here to see our standard legal disclosures.

The Spread Site Research

Receive our latest publications directly to your inbox. Its Free!.