Primers

Educational research to learn more about various markets and asset classes

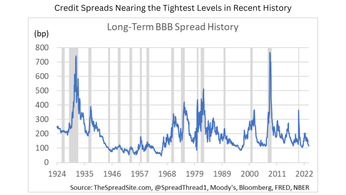

Corporate Credit Primer Paid Members Public

We put together a primer on corporate credit markets designed for someone with a low-to-moderate understanding of credit. We touch on most topics, at a high level, that we believe are important to understand when investing in the asset class. In future primers, we will dig into some of the

Closed End Funds: An Overview, Risks and Opportunities Paid Members Public

Summary * Given how much rates have risen, the Closed End Fund (“CEF”) asset class is becoming more interesting. We walk through CEFs in detail, discussing their structure, how they trade, ways they differ from mutual funds or ETFs, highlight some risks facing this sector, and end with a few recommendations.

Cap Rate Primer: Definitions, Calculations & Return Implications Paid Members Public

Summary * Capitalization Rates, or Cap Rates, are frequently used by real estate investors as a valuation tool. Simply, the formula is Net Operating Income / Property Value. This measure is used to compare across individual properties and/or sectors such as REITs. We break down both the numerator (Net Operating Income)