Market Insights

Top-down insights on the economy and macro markets

A Below Par Report Paid Members Public

Summary * Given this spike in rates over the past few months, a meaningful portion of corporate credit now trades at deeply discounted prices, which matters for valuations. In this week’s report, we walk through how to quantify the fair spread differential for high vs low dollar priced corporate bonds.

Assessing the Damage Paid Members Public

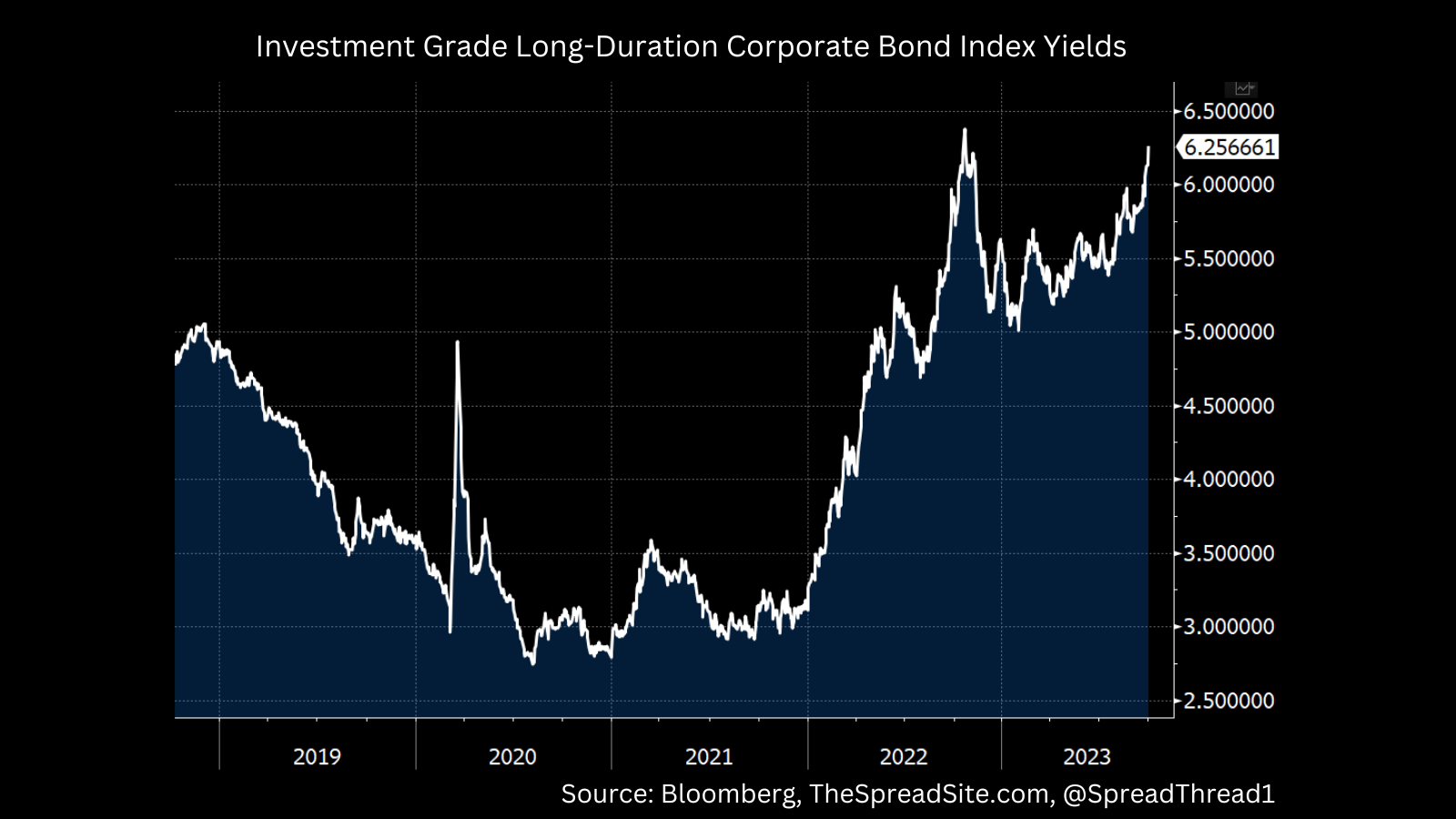

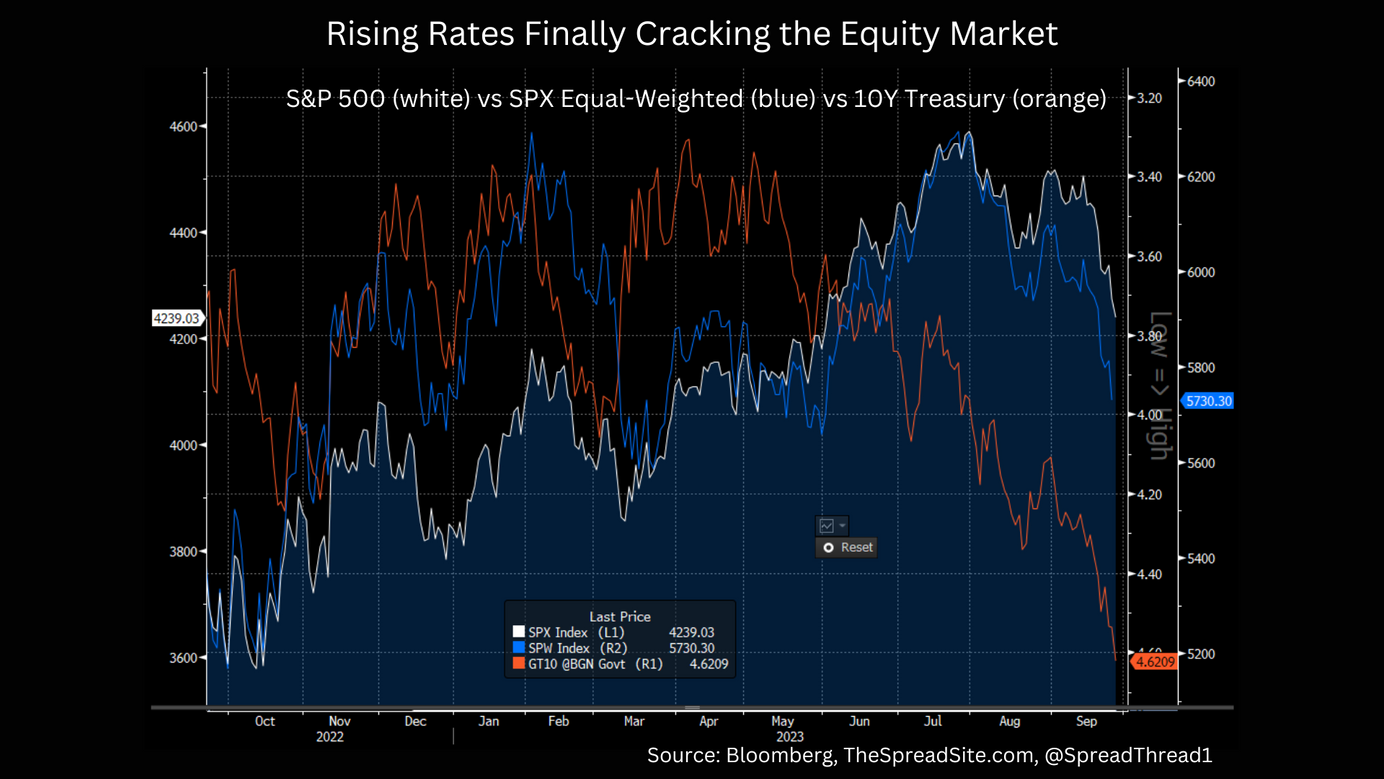

* Digging under the surface, we think markets are giving some important late-cycle messages. In short, any hint of an early-cycle re-acceleration is gone with sectors most sensitive to weakening credit, rising rates, and a slowing consumer rolling over– such as small-caps, banks, and consumer stocks. * In credit, IG yields are

UAW Strike: Shock Wave or Ripple? Paid Members Public

The UAW’s contract with the Big 3 (Ford, GM, Stellantis) ended on 9/14/23 and targeted strikes began that day. Contract negotiations cover ~146k workers across the companies. In this week’s note we discuss the key facts, impacts to the auto makers and their supply chain. Given

The Haves and Have Nots Paid Members Public

Summary * We often hear about the health of balance sheets, yet corporate, consumer and CRE defaults are all rising, now likely beyond the point of just ‘normalization,’ despite historically low unemployment. In our view, aggregate macro data at times misses the bifurcation under the surface that will impact defaults (and

Duration On Sale Paid Members Public

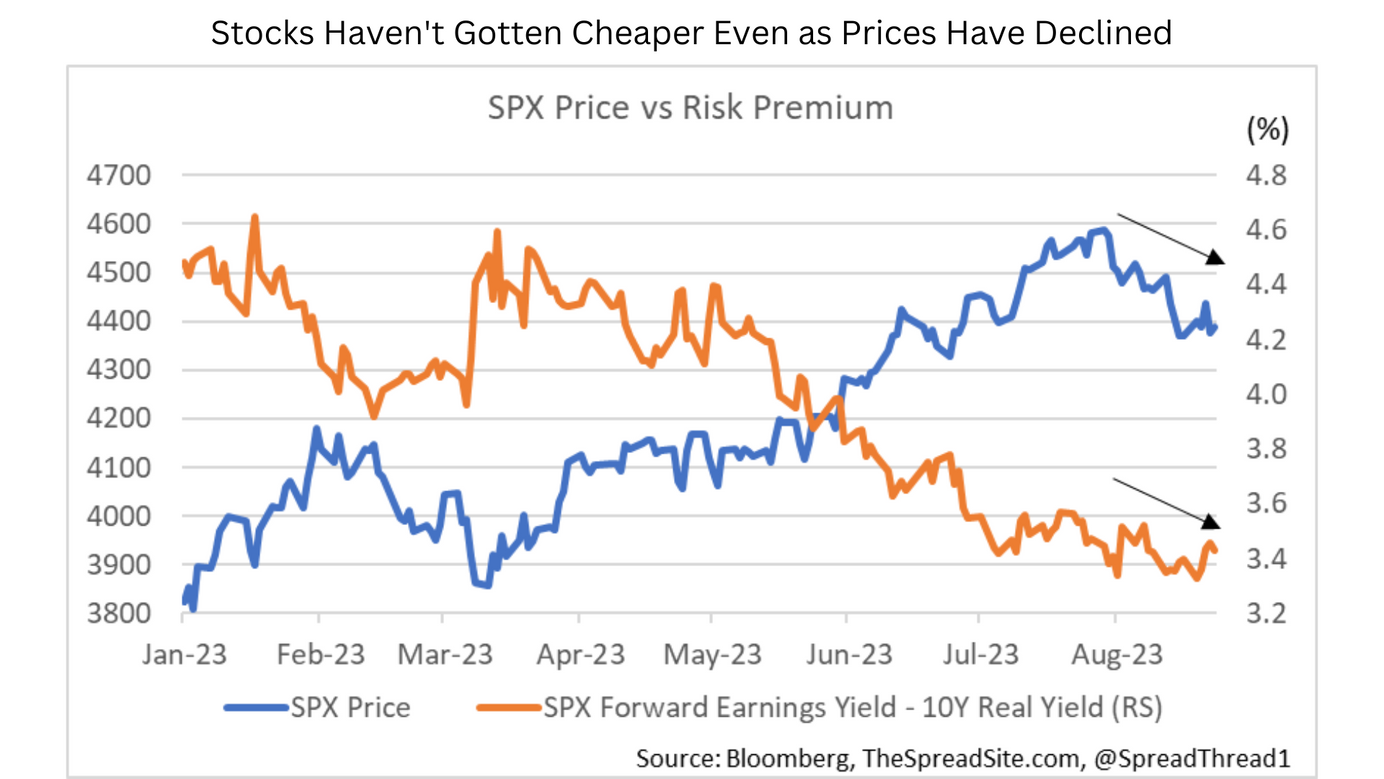

Summary * The equity market is arguably becoming MORE overvalued vs bonds, even as prices fall, because rising rates are offsetting lower P/Es. That said, we think stocks will ultimately need to see the impact of those higher rates (i.e., slower growth/ lower earnings) before declining in a much

The Lesser Evil Paid Members Public

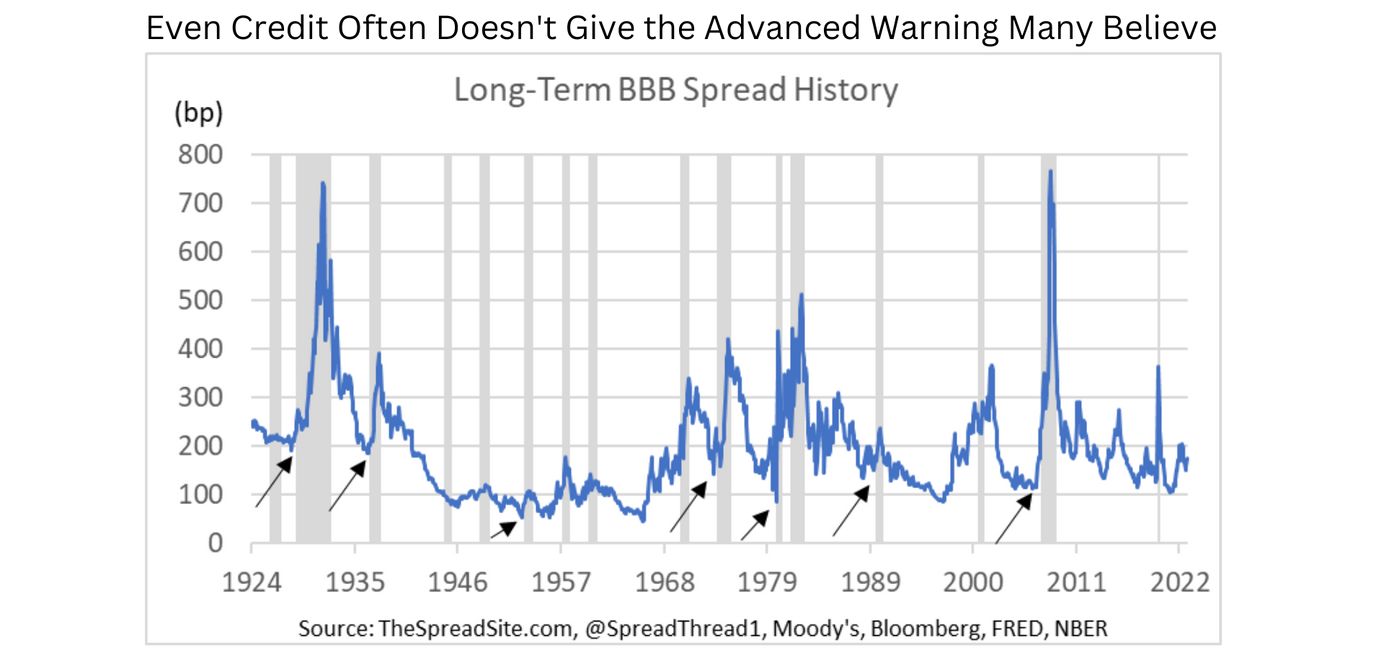

Summary * For this selloff to become more than just a pullback, the narrative needs to break one way or another – accelerating inflation, or recessionary data. Rising Treasury yields are clearly a short-term risk. But we think weak data, including jobs, will be the ultimate factor that turns a small pullback

A Late-Cycle Melt Up Paid Members Public

SUMMARY * The sharp rally YTD has many, us included, reassessing our market and macro views. However, we continue to believe that price action in 2022/23 is not abnormal for a late cycle period. * Markets often correct around when the Fed begins raising rates. Yes, it is not always a

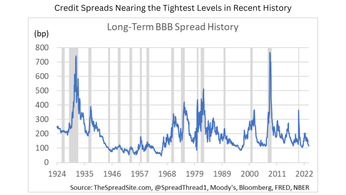

Cycle Through the Noise Paid Members Public

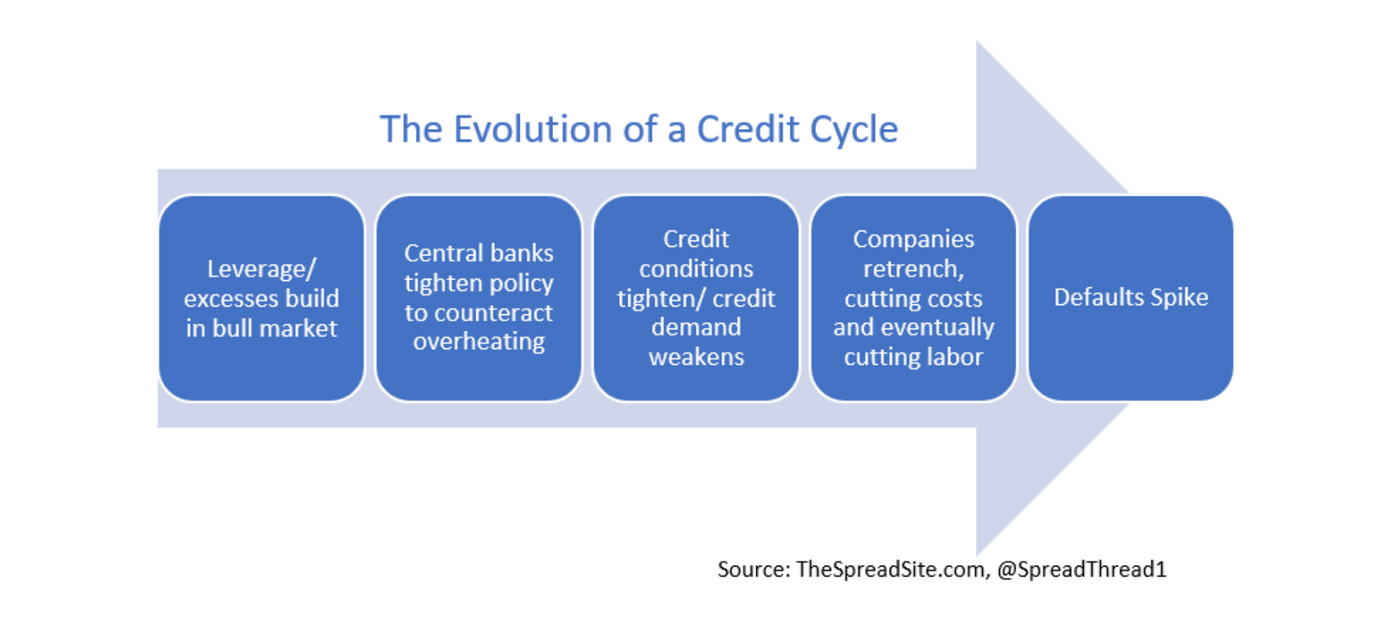

SUMMARY • In the following report, we lay out the progression of a typical credit cycle and how the market today fits into this analysis. While this cycle is clearly unique in many ways, the general pattern rhymes with history. • Leverage/excesses built up due to low rates for a long