The Lesser Evil Paid Members Public

Summary * For this selloff to become more than just a pullback, the narrative needs to break one way or another – accelerating inflation, or recessionary data. Rising Treasury yields are clearly a short-term risk. But we think weak data, including jobs, will be the ultimate factor that turns a small pullback

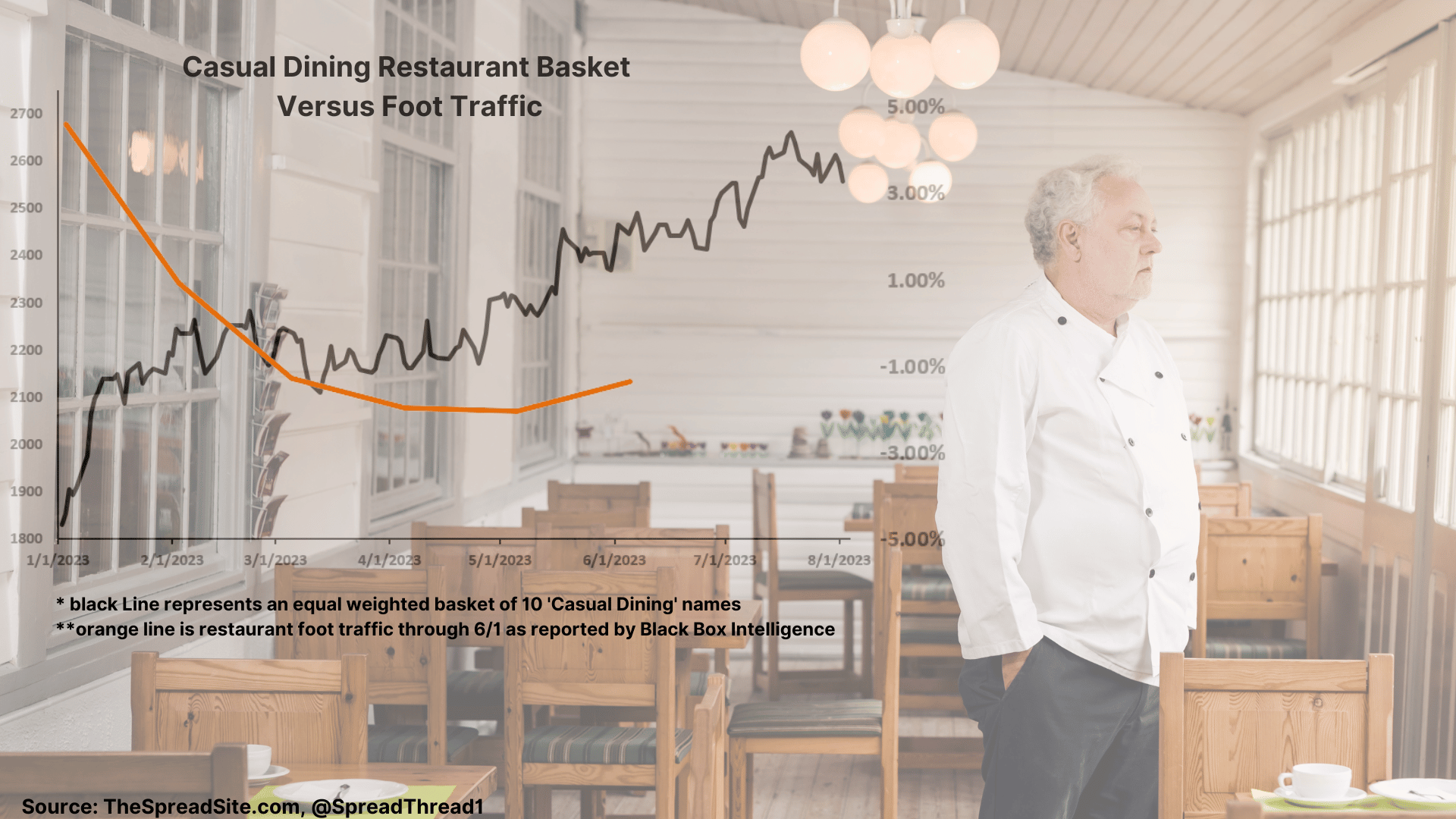

Restaurant Stocks to Face Macro Headwinds Paid Members Public

Summary * The service economy has been resilient, supporting stocks catering to consumer ‘experiences.’ We think several macro headwinds could change those dynamics. This week’s note provides an overview of the restaurant sector and a long/short basket to play this theme. * Student loan repayments are set to resume this

A Late-Cycle Melt Up Paid Members Public

SUMMARY * The sharp rally YTD has many, us included, reassessing our market and macro views. However, we continue to believe that price action in 2022/23 is not abnormal for a late cycle period. * Markets often correct around when the Fed begins raising rates. Yes, it is not always a

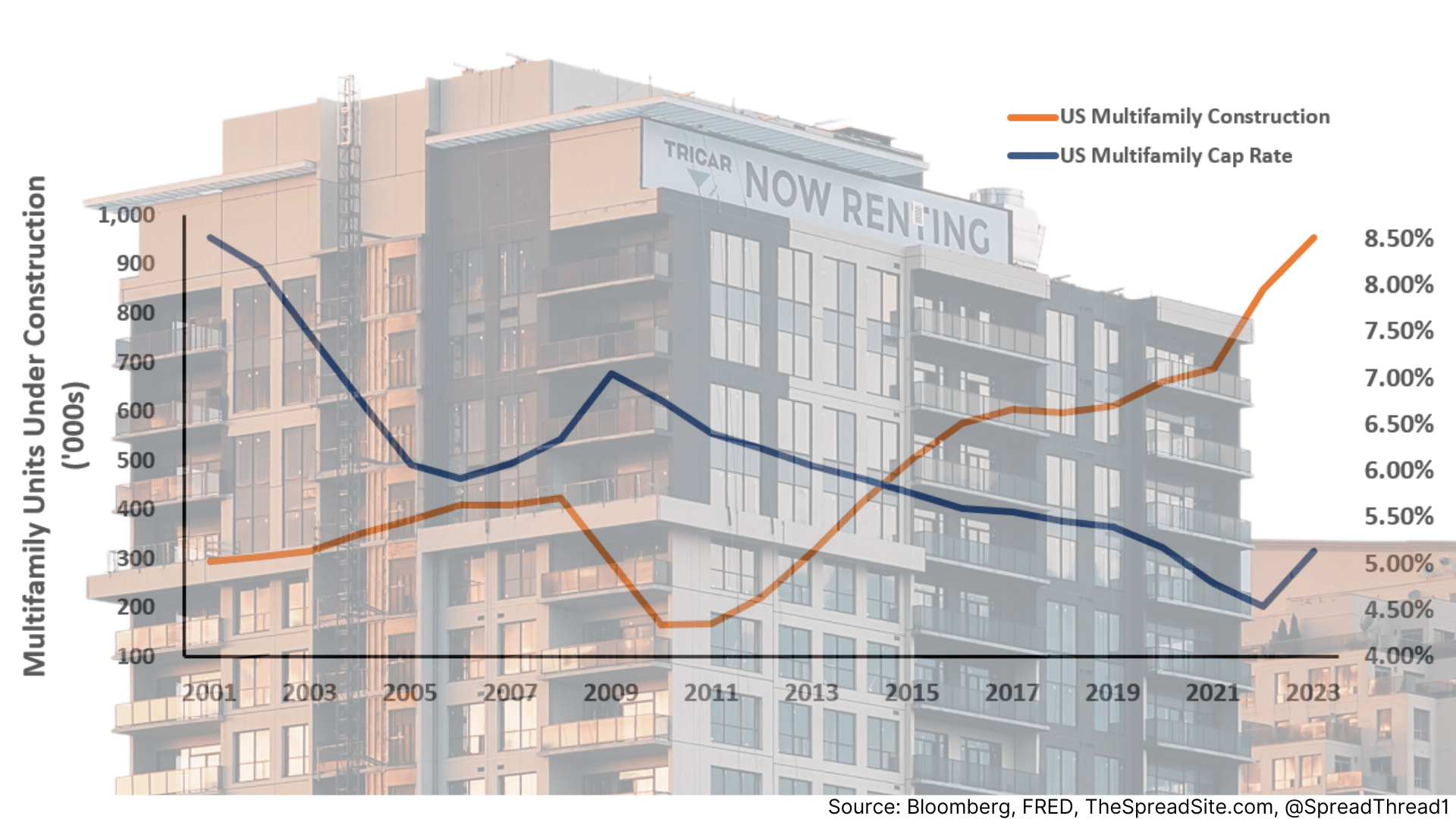

Everyone's Starting a Multifamily Paid Members Public

SUMMARY * The current risk/reward for multifamily ("mFam") REITs is unattractive given our view that rent growth and vacancies will worsen, cap rates are too tight, headline risk for CRE in general is elevated, and higher fixed income yields mean better alternatives for yield-focused investors. * Macro headwinds include

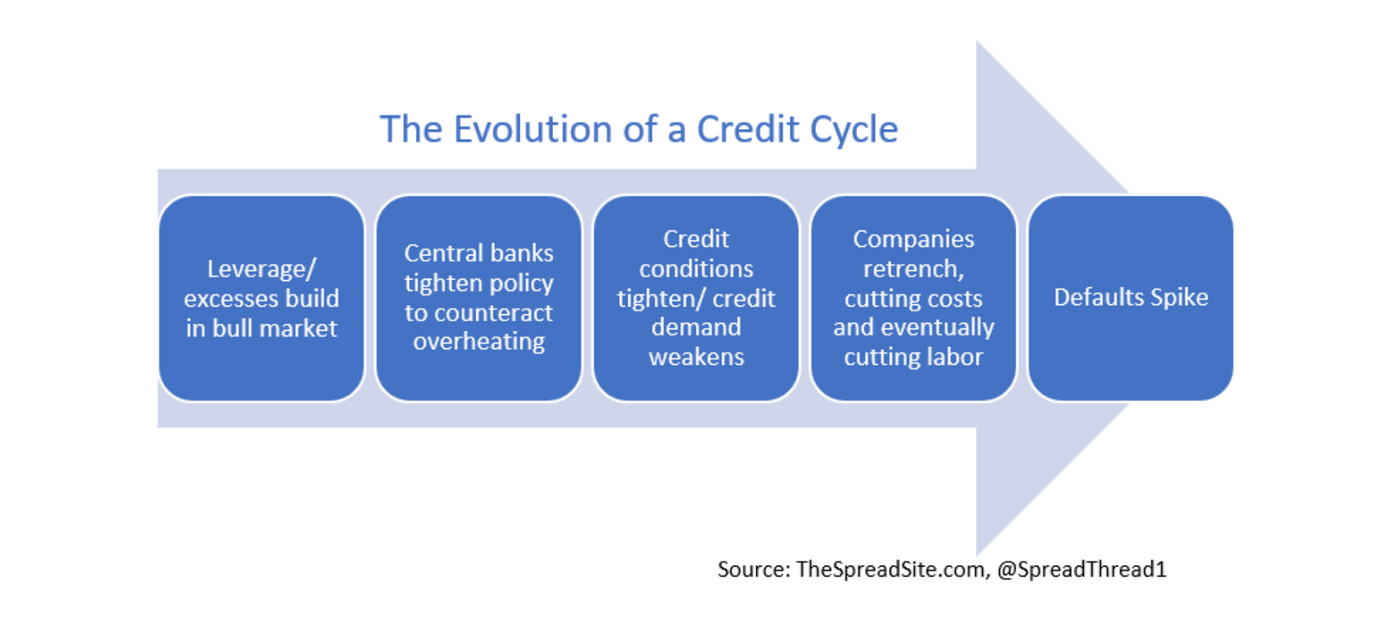

Cycle Through the Noise Paid Members Public

SUMMARY • In the following report, we lay out the progression of a typical credit cycle and how the market today fits into this analysis. While this cycle is clearly unique in many ways, the general pattern rhymes with history. • Leverage/excesses built up due to low rates for a long