UAW Strike: Shock Wave or Ripple? Paid Members Public

The UAW’s contract with the Big 3 (Ford, GM, Stellantis) ended on 9/14/23 and targeted strikes began that day. Contract negotiations cover ~146k workers across the companies. In this week’s note we discuss the key facts, impacts to the auto makers and their supply chain. Given

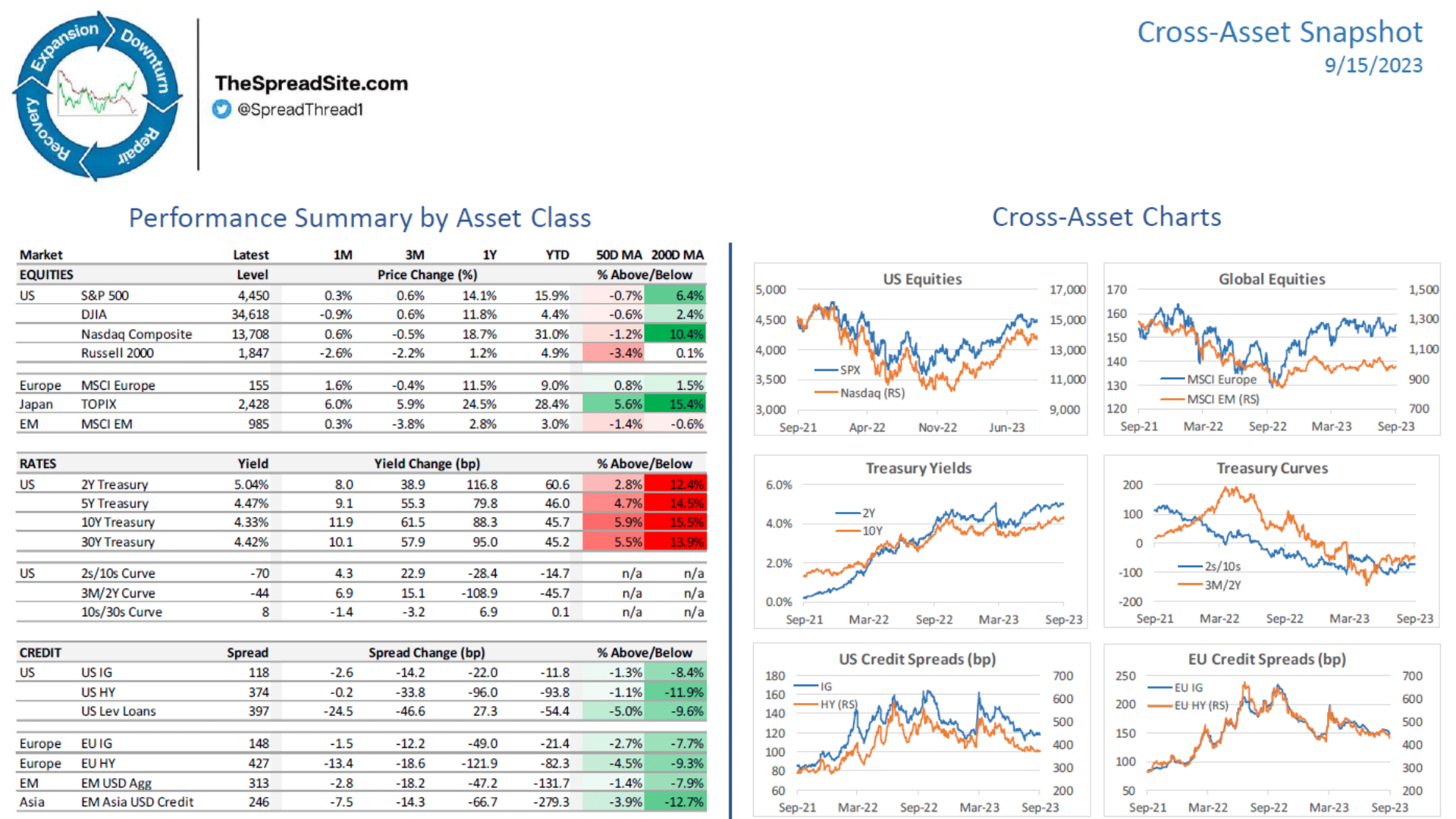

Cross-Asset Snapshot Paid Members Public

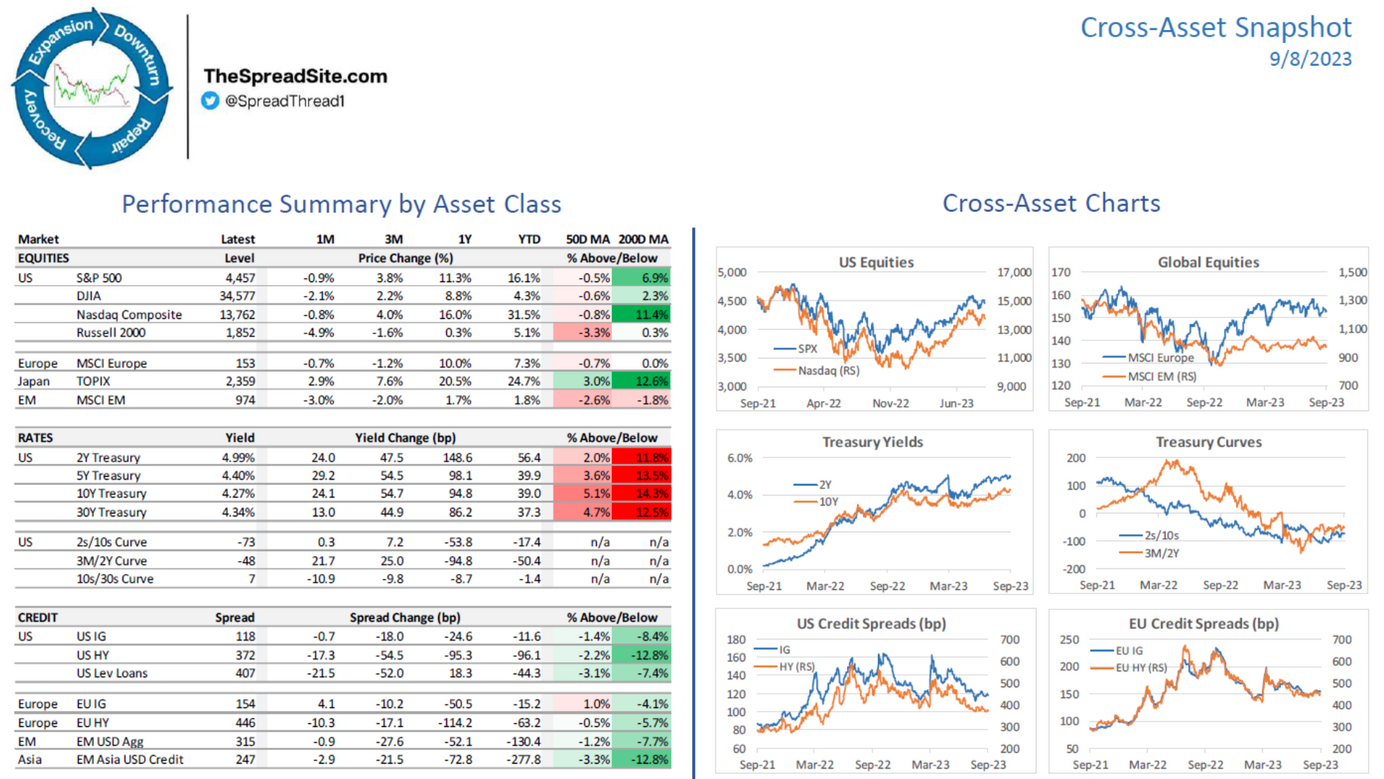

Cross-Asset Snapshot Paid Members Public

Closed End Funds: An Overview, Risks and Opportunities Paid Members Public

Summary * Given how much rates have risen, the Closed End Fund (“CEF”) asset class is becoming more interesting. We walk through CEFs in detail, discussing their structure, how they trade, ways they differ from mutual funds or ETFs, highlight some risks facing this sector, and end with a few recommendations.

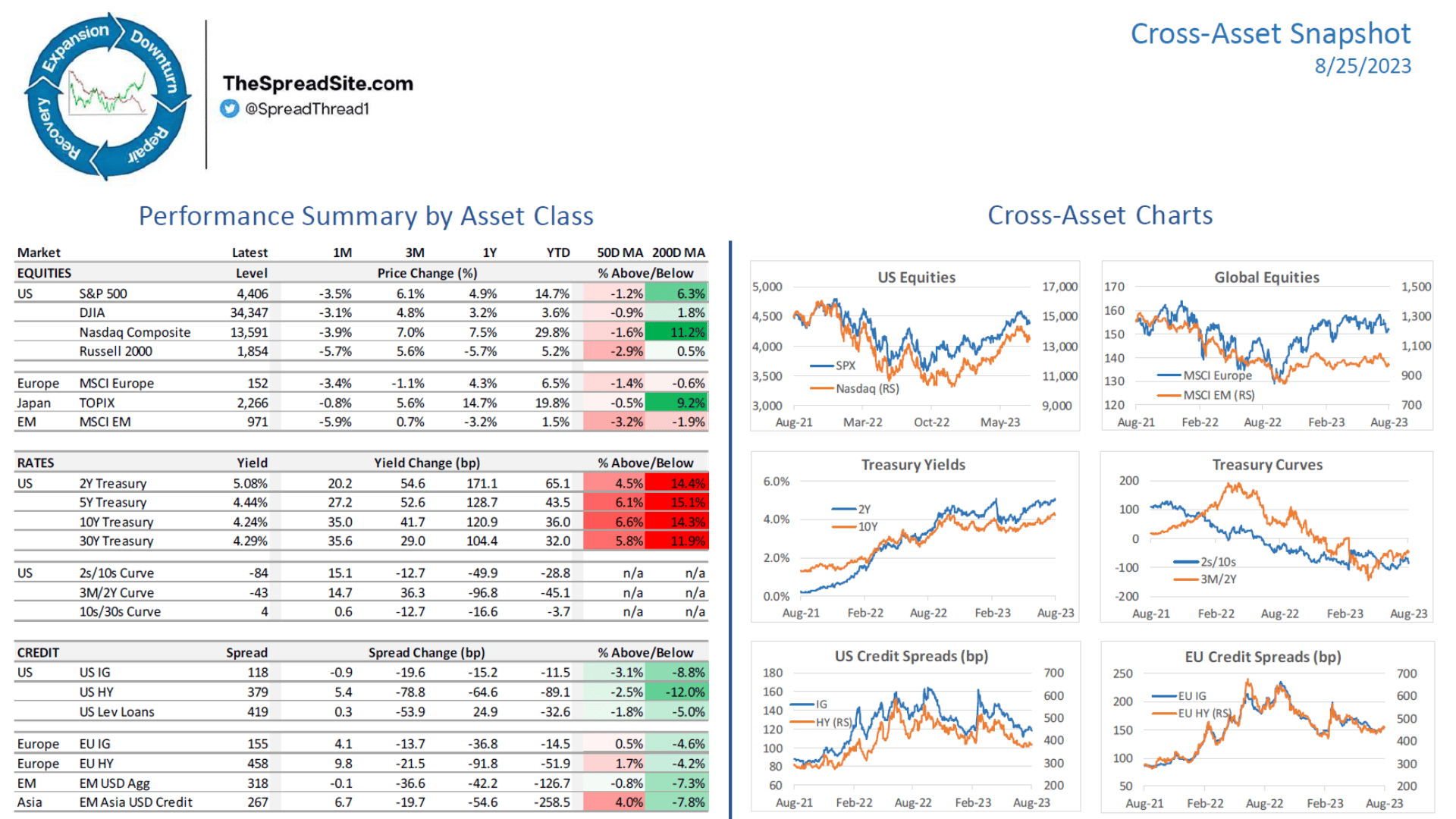

Cross-Asset Snapshot Paid Members Public

Published & Updated Weekly

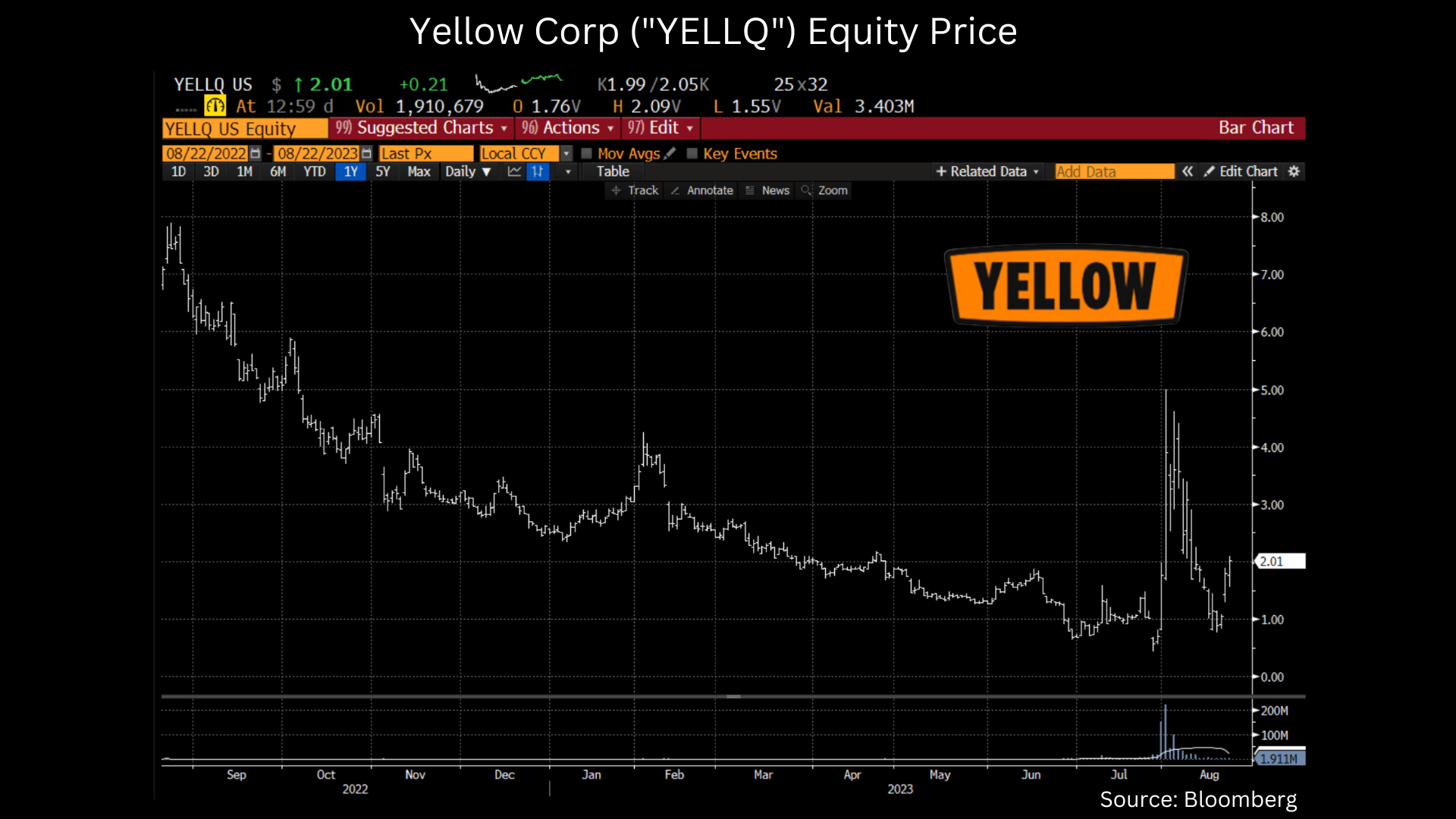

Yellow Corp ("YELLQ"): A Ch.11 Liquidation With Multiple Moving Pieces Paid Members Public

Chapter 11 & Pre-Petition Equity On August 6, 2023, Yellow Corporation filed for Chapter 11 under the US Bankruptcy code, case# 23-11069. For case information, a list of advisors, and all public documents you can visit the case management website here. Given a long history of liquidity and union problems

Cross-Asset Snapshot Paid Members Public

Published & Updated Weekly

Cap Rate Primer: Definitions, Calculations & Return Implications Paid Members Public

Summary * Capitalization Rates, or Cap Rates, are frequently used by real estate investors as a valuation tool. Simply, the formula is Net Operating Income / Property Value. This measure is used to compare across individual properties and/or sectors such as REITs. We break down both the numerator (Net Operating Income)